By Jessica Walker

Communications and Campaigns Manager | Pou Whakahaere Whitiwhiti Kōrero, Kaupapa Whakatairanga

In July, the minister for commerce and consumer affairs announced that in-store surcharges would be banned by May 2026.

Consumer NZ was thrilled by this decision. We’ve been calling for the surcharge situation to be sorted out since 2017.

Earlier this year, we told the Commerce Commission that surcharges – those extra fees customers pay for making some types of card payments – are a national embarrassment. We don’t use such words lightly.

The problem with surcharges

If you pay for goods or services by credit card or contactless debit card, chances are you’ve been stung by an unexpected or excessively high surcharge at some point.

We’ve even heard of people being hit with a surcharge for using their EFTPOS cards.

At present, there are no surcharge regulations in New Zealand. There are only guidelines that businesses are supposed to follow. The guidelines recommend surcharges be transparent, avoidable and not excessive.

But often, they’re none of those things.

The commission says anything above 2% is likely to be an excessive surcharge. Yet, Consumer receives hundreds of complaints about surcharges, some of which have been well above 2%.

The worst surcharge we’ve heard about this year was a nail salon that charged 25%.

Many people we hear from are annoyed they’ve been caught out by surcharges. Either they didn’t know the percentage they were going to be charged – just that ‘a surcharge applies’ – or the merchant didn’t disclose they’d be charging a surcharge at all.

Why do we currently pay surcharges?

Surcharges were once banned in New Zealand.

Currently, though, merchants – that’s anyone selling goods or services – can legally charge customers an extra amount to cover the additional costs associated with accepting credit and contactless debit card payments.

The problem is we don’t know how much it costs a particular merchant to accept these payments, so we don’t know if we are being overcharged.

The Commerce Commission has acknowledged that excessive surcharging could be costing New Zealanders up to $65 million per year. Mastercard estimates the amount to be $90 million.

The introduction of the Retail Payment System Act back in November 2022 was supposed to lead to lower surcharges. The commission estimated that businesses would save $105 million per year after the act was passed

But we haven’t seen any proof that those savings are being passed on to consumers.

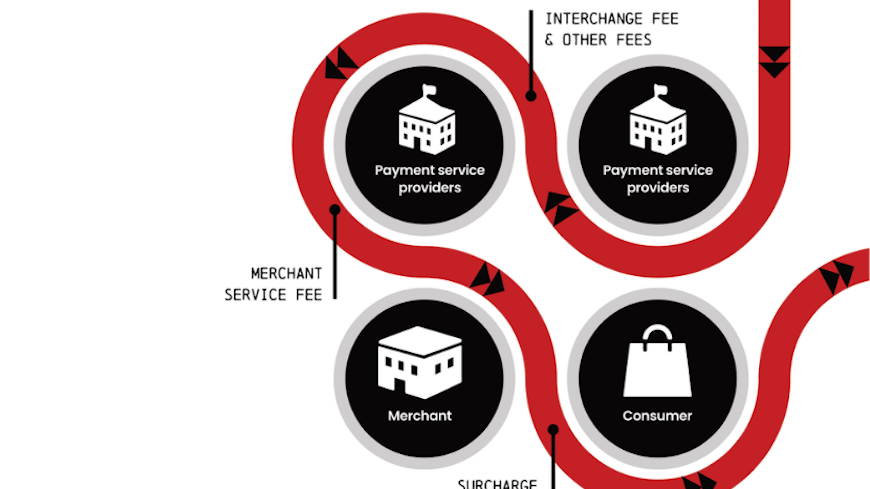

How our payment system currently works

It’s fair to say New Zealand’s payment system is complicated.

Every time a credit or contactless debit card is used, the merchant’s bank pays a fee (called an interchange fee) to the bank that issued the card. Interchange fees make up a hefty chunk of the merchant service fee that merchants pay to their banks to be able to accept card payments (about 60%).

Merchants don’t have to pay a merchant service fee if a customer pays with EFTPOS or inserts or swipes a debit card. That’s because these types of transactions go through the EFTPOS network, rather than the credit card network.

Which means you shouldn’t ever have to pay a fee for EFTPOS or swiping or inserting a debit card.

Merchants can pass on merchant service fees to their customers in the form of a surcharge. However, not all merchants choose to do this. Some prefer to absorb the fees and recover the cost through the prices of their goods or services.

According to the commission, the average merchant service fee is approximately 1%, but the average surcharge is approximately 2%.

That shows the commission’s guidelines, which state surcharges can’t exceed the cost to the business of accepting the payment, aren’t working.

Payment changes are coming

On 17 July, the commission announced its decision to reduce interchange fees for Visa and Mastercard payments. It said this would reduce costs for businesses by around $90 million a year.

Less than 2 weeks later, the minister for commerce and consumer affairs announced that in-store surcharges would be scrapped.

We think both those announcements are great for consumers.

A surcharge ban should put an end to excessive, hidden and unavoidable in-store surcharges. Knowing card payment surcharges can’t be added in the store, will create a simpler system for consumers and offer more clarity and consistency for merchants.

It’ll also bring us into line with other jurisdictions, like the UK and EU. The Reserve Bank of Australia is currently considering a ban too.

Will businesses raise their prices?

When the in-store surcharge ban takes effect – by May 2026 – merchants that currently apply a surcharge will need to decide whether to absorb the cost of card payments or adjust their prices to include these costs.

If a business decides to increase its prices, because it now has reduced interchange fees, those increases should be minimal – around 1%.

Compare that with some current surcharges, which sit in the realm of 15% to 20%, and it seems like the ban is a no-brainer.

A ban will bring an end to a very messy situation and put a large chunk of the $65 million currently being paid in excessive surcharges back in consumers’ pockets.

The ban does mean people using low-cost payment methods, like cash or EFTPOS, could end up subsidising higher cost payment methods, like credit cards. However, this is happening already in stores that don’t charge surcharges, and in those that apply a flat surcharge rate across different payment methods.

What about online payments?

Consumer is disappointed that the surcharge ban won’t extend to online payments.

People purchasing goods and services online may still have to pay a surcharge.

We haven’t been advised the exact reason for excluding online payments but think it could be because these payments are more expensive for merchants to accept.

Despite this, online payment surcharges are a common cause of complaint.

So we’re still pushing to have the surcharge ban extended to all payments.

On 22 October, representatives from our advocacy team appeared at the Finance and Expenditure Select Committee, where they shared examples of extremely high surcharges that have hit people making online bookings.

They took the opportunity to urge the committee to extend the surcharge ban to payments made online – like has already been introduced in the EU and UK and is being considered in Australia.

Our advocates also suggested the government brings in all-inclusive pricing rules to put an end to sneaky add-on fees.

We’re pleased with the ban that’s coming but more still needs to be done.

Our team will be keeping a close eye on the surcharge situation.

If you’re hit with a high online surcharge, we’d love you to share any evidence with us by emailing: [email protected]

Subscribe to our newsletters

Get even more Consumer NZ news and invitations to share your voice on important issues straight to your inbox. You don’t have to be a member to have these newsletters emailed to you regularly.

Comments

Was this page helpful?

Related articles

5 ways the house insurance market isn’t working for New Zealanders

The surge in surcharges: why are we paying so much?

10 of us asked our power company a simple question – now 3 have cheaper bills