By Ruairi O'Shea

Former Investigative Writer | Kaituhi Mātoro

Inland Revenue (IRD) is currently sitting on $615,882,000 in unclaimed funds. Here’s how to find out if any of it belongs to you.

There is a big pot of money at IRD labelled “unclaimed money”.

Unclaimed money is cash held by a person or organisation, like a solicitor or a bank, where the owner of the money cannot be found. Generally, this takes place after 5 years but there are cases when it can happen after less than 5 years. After this time, it is transferred to IRD.

But enough about what it is. Here’s how you can find out if you’re entitled to any of it.

How to check if you are entitled to IRD unclaimed money?

If you have a myIR account, the easiest way to check if you can claim unclaimed money is to log into myIR.

Under the ‘I want to…’ tab, scroll down to ‘Registration, application and enrolment’ and click on ‘Apply for unclaimed money’.

There is also a form that allows you to search for unclaimed money and apply for any that match your details.

The IRD also has a publicly searchable database, which allows you to search for unclaimed money:

on behalf of an organisation, trust or estate

for an individual other than yourself

for yourself under a different name than the one you have used with IRD

for yourself if you do not have a myIR account.

What you need to make a claim

To submit a claim for money, you’ll need to provide proof that the money belongs to you, for example:

past contact information such as addresses you lived at when you had the account related to the unclaimed money

a copy of an old statement or other correspondence showing your connection with the person or organisation who passed the money to IRD

if it is the unclaimed money of an estate, a copy of the will, death certificate, Letter of Administration or other evidence that you have authority to act for the estate.

If you are acting on behalf of someone else, you need to provide evidence that you have authority to act for them.

IRD can take a minimum of 12 weeks to process claims for unclaimed money.

How big could my claim be?

IRD told us that the size of the average fund waiting to be claimed is $1,100, but some funds are much larger. We’ve seen one fund for over $50,000.

Not all claims are successful.

In 2023/24, IRD processed 23,000 claims for unclaimed money, approving 4,300.

In total, it paid out $36.5 million.

What happens to money that is not claimed

Unclaimed money is held by IRD for 25 years.

If it remains unclaimed after that time, it is transferred to the Crown.

How money becomes unclaimed

Unclaimed money is different to a tax refund.

Unclaimed money is money that has been left untouched by its owner in the bank, or with someone such as a solicitor. After the organisation holding the money has been unsuccessful in trying to find the money’s owner, the unclaimed money is transferred to the IRD.

Generally, money becomes unclaimed if it has not been accessed for 5 years.

IRD administers unclaimed money that comes under the Unclaimed Money Act 1971. This includes:

deposits in banks and financial institutions

money in solicitors’ trust accounts

unpaid wages and employee benefits (including unpaid holiday pay)

proceeds of life insurance policies.

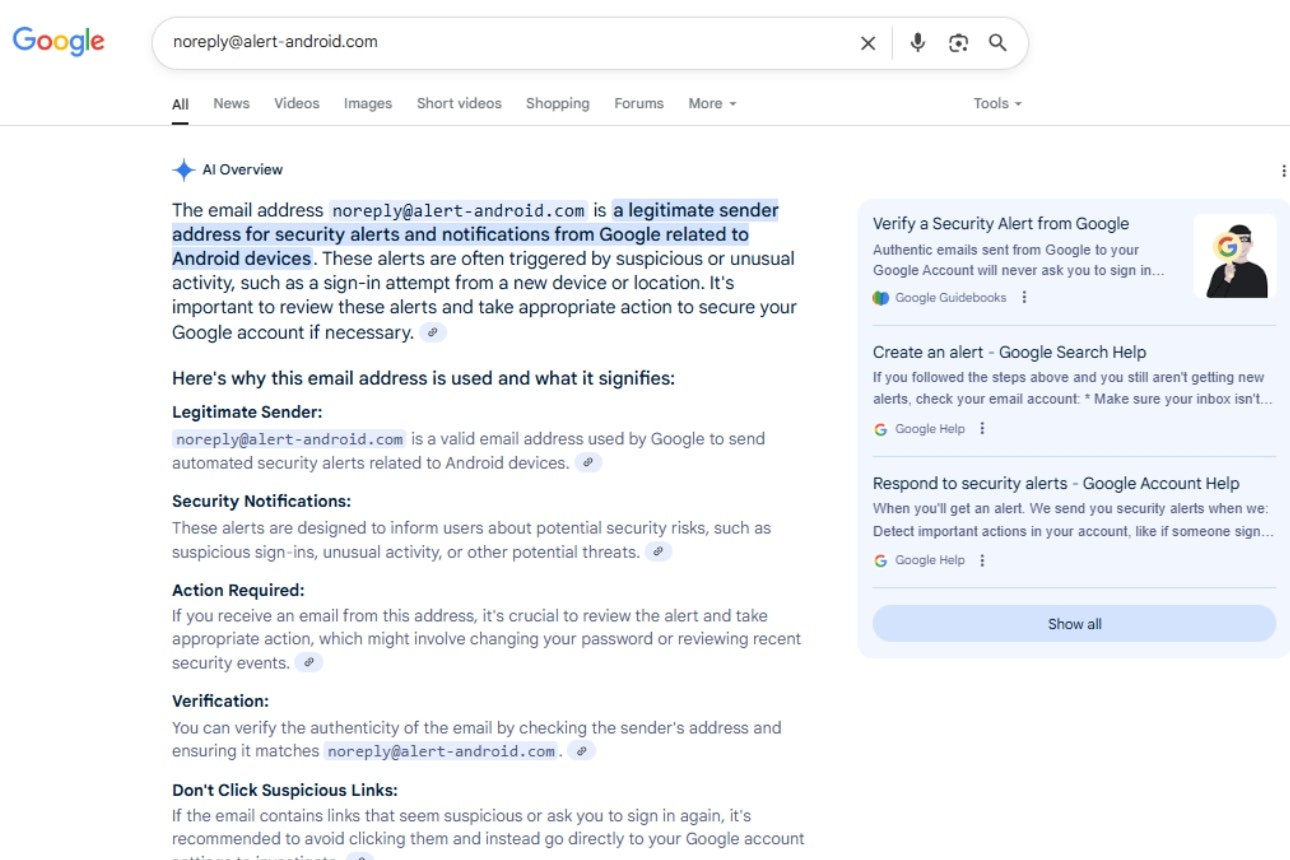

Beware of scammers

Our article How I got caught out by a tax scam shows how scammers can take advantage of genuine reasons people might be owed money by IRD.

An unclaimed money scam is when scammers tell you that you are owed a sum of money and just need to provide personal information, or a deposit, in order to access it.

Unlike a tax refund, IRD will never contact you proactively about unclaimed money.

So, while it’s exciting to think there might be a lump of money waiting for you with IRD, its important to be vigilant. There can be exceptions, but if something seems too good to be true, it generally is.

IRD have some useful information on their website on how to spot the signs of a scam.

Stamp out scams

Scams are on the rise, with over a million households in NZ targeted by scammers in the past year. Help us put pressure on the government to introduce a national scam framework that holds businesses to account.