By Ruairi O'Shea

Former Investigative Writer | Kaituhi Mātoro

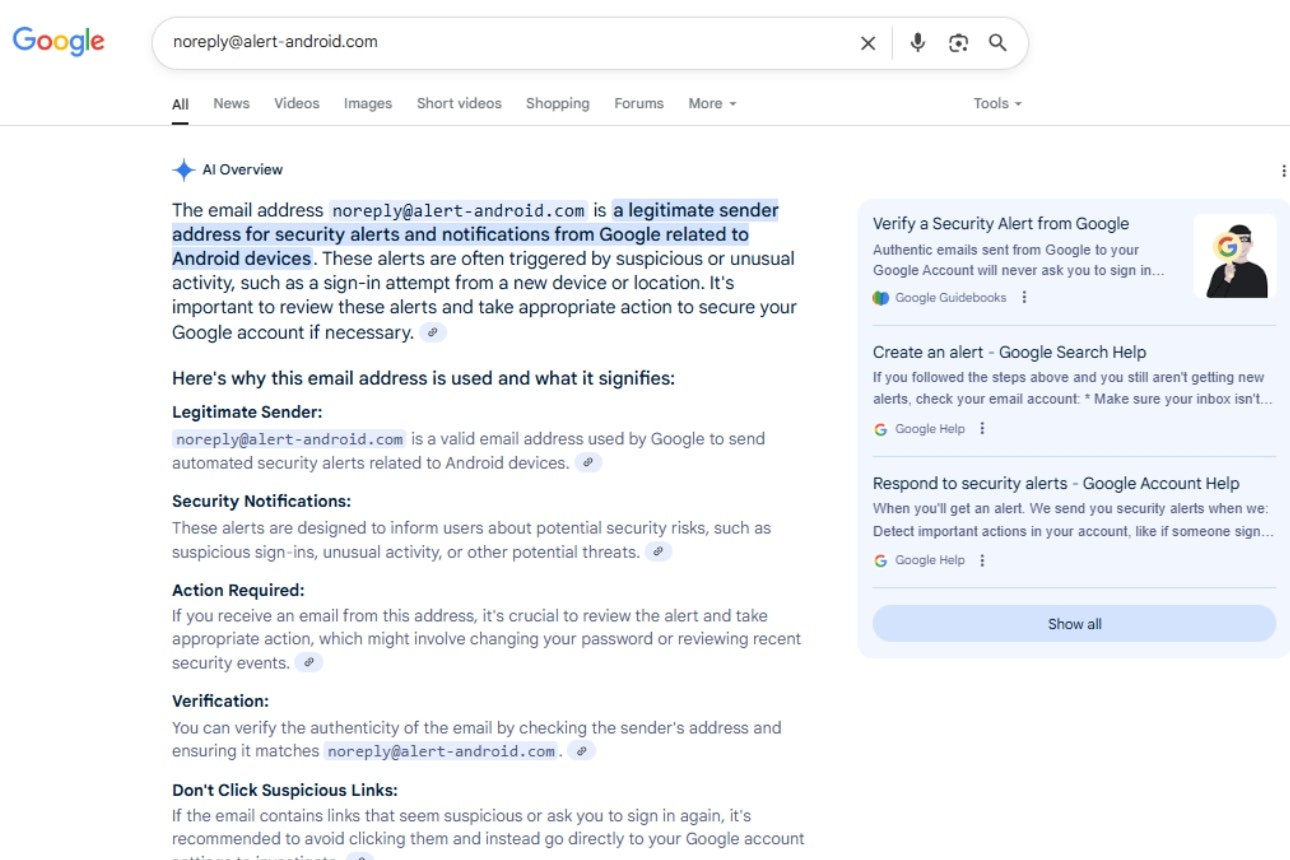

At the end of last year, a government inquiry asked each of the banks how much they lost to scams. Some banks were more forthcoming with this information than others, and each reported the information differently.

As a result, we can’t tell you definitively which banks lose the most money to scams. We don’t think that’s good enough. Consumers in New Zealand – like those in the United Kingdom – should have access to this information, so they can put their money where it’s safest.

No obligation to report scam losses

In New Zealand, banks have no obligation to report their scam losses.

However, as part of a 2024 parliamentary inquiry into banking competition, New Zealand’s banks were asked how many scams their customers had experienced and how much the average loss was over the past 3 years.

Banks report scam losses differently

While most of the banks provided the information – except ANZ and Kiwibank – they all used different statistics to convey their scam losses, covering different time periods.

One bank told the government about its total scam losses.

Another revealed its losses including scams it had prevented.

Others told the government about their total losses minus the funds recovered from scams and reimbursed to victims (the net loss).

Fraud and scams

Some banks made a distinction between fraud and scams.

Where banks refer to fraud, they are generally referring to unauthorised access – when someone gains access to your internet banking.

When banks refer to scams, they are generally referring to scams where victims are tricked into sending a scammer money (these are known as authorised-push-payment (APP) events).

We don’t agree with this breakdown, so are using the word ‘scams’ to cover crimes orchestrated using either unauthorised access or APP scams.

Inconsistencies in banks’ data makes comparisons impossible

We’ve rounded figures to one decimal point and highlighted where figures represent the calendar or financial year.

Because of the differences in how banks report these statistics, we can’t say confidently whether one bank is losing more or less to scams than any other bank.

To get comparable data, we asked New Zealand’s major banks how much they lost, how much they recovered and how much they reimbursed to victims for the 2024 period (the net loss).

Unfortunately, none of the banks were willing to share this information with Consumer NZ.

So, here’s what they told the government.

What the banks told the government about scam losses

ANZ New Zealand

Reported scam loss (2024 financial year): $31.5 million

Net profit after tax (2024 financial year): $2.3 billion

Losses as % of profit: 1.38%

Market share*: 27.1%

ANZ did not reveal its scam losses to the banking inquiry when asked but did provide figures when Consumer followed up.

ANZ told us their customers lost over $31 million to scams in the 2024 financial year, with an average loss of $285.96 across 110,023 cases.

ANZ’s data represents ‘net losses’ to scammers, including funds recovered from scammers and reimbursed to customers.

ASB

Reported scam loss (2024): $16 million

Net profit after tax (2024 financial year): $1.4 billion

Losses as % of profit: 1.18%

Market share*: 17.6%

ASB’s customers lost over $16 million to fraud and scams in 2024, with an average loss of $122 across 131,512 cases.

Like ANZ, the figures ASB reported are what it defines as ‘net loss to the customer’.

We asked ASB to provide a breakdown of these figures – including how much was recovered and how much was reimbursed to victims. However, it declined to provide the information, citing sensitivity.

BNZ

Reported scam loss (2024): $40.3 million

Net profit after tax (2024 financial year): $1.5 billion

Losses as % of profit: 2.68%

Market share*: 18%

BNZ reported fraud and scam losses of $40 million in 2024.

That included 1,430 cases of unauthorised access, with an average loss of $2,429 per case. In addition, BNZ reported 3,408 cases of APP fraud, with an average loss of $10,812.

BNZ’s response to the banking inquiry includes what it describes as the ‘gross loss’. This includes scam activity that it prevented, recovered or reimbursed.

Kiwibank

Reported scam loss (2024): Did not disclose loss

Net profit after tax (2024 financial year): $202 million

Losses as % of profit: Did not disclose losses

Market share*: 9%

Kiwibank did not reveal its scam losses to the banking inquiry when asked.

When we followed up – after Kiwibank had the opportunity to look at the losses reported by other banks – it still declined to disclose its loss figures.

Westpac

Reported scam loss (2024 financial year): $13.7 million

Net profit after tax (2024 financial year): $1.1 billion

Losses as % of profit: 1.3%

Market share*: 18.6%

Westpac reported scam losses of $13.7 million in its 2024 financial year, with an average loss of $452.34 from 30,370 instances of fraud.

Westpac say that this sum does not include the amount recovered from scammers or the amount reimbursed to victims.

Don’t bank on this data

Unfortunately, because the banks have provided their figures in different ways, covering different periods of time, we can’t make direct comparisons.

And while showing this data side by side might be unfair on some banks, we think the situation is far worse for consumers. Consumers can’t find out whether their current bank is less safe, or less likely to reimburse them, than a competitor.

Standardised data is a simple solution to the problem

A simple solution to this problem would be for the banks to report the same data, for the same period, in a standardised way.

This would allow consumers and government agencies to understand whether there are significant differences in the banks’ security measures and reimbursement policies.

We can see how this works in the United Kingdom. There, banks are required to report extensive data on APP scams (where a scammer tricks you into sending them money, rather than directly accessing your bank account). Banks must report:

the amounts they lose

the frequency of scams

the percentage of losses that are reimbursed

the percentage of victims fully or partially reimbursed.

That allows consumers to quickly understand whether their bank loses more money than a competitor bank and whether their bank is stingy when it comes to reimbursement.

We need standardised scam data

Estimates of scam losses range between $200 million and $2 billion annually in New Zealand, and we have little understanding about how losses differ across the banking industry.

Are there banks in New Zealand that have not put enough protections in place to help prevent scams?

Is there a bank that reimburses a particularly low percentage of losses, leaving its customers to deal with the fallout from scams alone?

We think having access to the information to answer these questions is vital.

It will help find and fix weaknesses in our scam prevention infrastructure. Plus, it will help consumers make informed decisions about where their money might be safest, or which bank is most likely to look after them if something goes wrong.

We need standardised scam data from New Zealand’s banks.

*Market share data sourced from the Banking Ombudsman Scheme’s Complaints dashboard

Stamp out scams

Scams are on the rise, with over a million households in NZ targeted by scammers in the past year. Help us put pressure on the government to introduce a national scam framework that holds businesses to account.