By Ruairi O'Shea

Former Investigative Writer | Kaituhi Mātoro

Open banking is up and running in New Zealand – four of our major banks have offered open banking services since May 2024.

But what is open banking, and how could it improve your life?

What is open banking?

Open banking lets you share your banking data with third parties, so you can get the most out of your financial information.

If it works well, open banking should see the banks competing to provide consumers with the best banking service. It should also mean they have to compete with new financial technology companies that can help you use your money better.

There are two main ways open banking works.

Payment initiation: With open banking, you can pay businesses in real time without using a middleman, like Visa or Mastercard, and paying the surcharges that come with them.

Account information: With open banking, you can instruct your bank to share your financial information with third parties – anything from budgeting apps to financial advisers – so you can understand and manage your money better.

Open banking is in its infancy in New Zealand, and at present, many of its most useful features are not available to consumers here. However, by looking to the United Kingdom, and popular applications of the technology, we can see how we might use it in the future.

Here are five ways to use it to improve your life.

1. Make real-time payments without surcharges

Open banking could let consumers make account-to-account payments in real time without paying surcharges.

This is a significant development in New Zealand. We are one of the few advanced economies on Earth without a real-time payment network that allows us to send money from our bank accounts to a business bank account in real time.

Instead, we rely on payment service providers like Visa or Mastercard, leaving us exposed to surcharges. Consumers in New Zealand currently pay between $65 million and $90 million a year in excess surcharges, and there is huge potential for open banking to save consumers this wasted money.

Each of the four major banks now enable their customers to make open banking payments to businesses, friends and family, using open banking enabled third parties like BlinkPay, Qippay or Volley.

2. Improve your budgeting

Open banking makes it easy to share your financial information with budgeting applications and services.

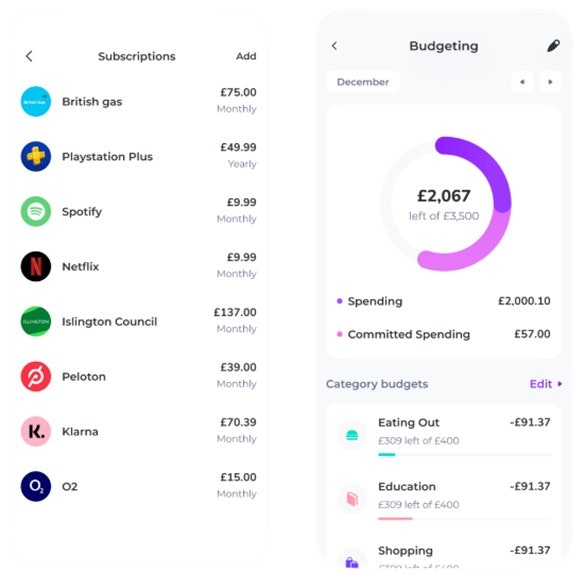

Budgeting services can provide highly sophisticated analyses of your finances. They will collate your outgoings – subscriptions, utility payments, day-to-day spending – and track them in relation to your income.

If you’re halfway through the month and you’ve spent 75% of your income, budgeting apps can give you a nudge to slow down on the spending. They’ll help you understand where your money is going – for example, by analysing how much you’re spending on items like transport or eating out – which can help you rein in your spending, if you’re regularly spending more than you’re bringing in.

Source: Emma App

We are not aware of any open banking facilitated budgeting apps in New Zealand at present, but you can find out more about how these applications work, and the type of services being offered to consumers in the United Kingdom, by checking out the article from United Kingdom’s Which? Best budgeting apps 2025.

3. Manage your subscriptions

Open banking makes it easier to manage subscriptions, so you’re not paying for services you’re no longer using.

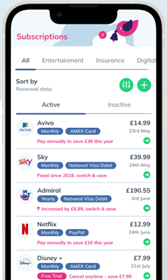

Source: Little Birdie App.

From streaming services and cloud storage to gym memberships and food boxes, it can be hard to stay on top of the various subscriptions we sign up to.

We’re not aware of any open banking facilitated app in New Zealand, but in the United Kingdom, consumers can use an app called Little Birdie, which helps to manage subscriptions.

It tells you when payments are coming out of your account, how often and whether you can save by paying annually. It also offers an app-cancellation service with over 400 vendors, so you can manage and cancel subscriptions from one place, rather than having to manage each service through a separate platform.

4. Provide financial information

Open banking can take the hassle out of getting a financial assessment by letting you share your complete financial portfolio with a financial adviser or lender at the push of a button.

It can also save time in pulling together your financial information before you apply for a mortgage.

Because lenders can access more complete financial information, they’re better able to understand your full financial position, reducing lending risk and creating opportunities for cheaper borrowing.

Because it provides comprehensive information about an individual’s financial position, open banking can make it easier for people with no credit history to demonstrate they are suitable for credit, improving financial inclusion.

5. Save and invest automatically

Once you’ve used open banking to tighten your budget and cancel your subscriptions, you might find yourself with some savings to invest.

The main role for open banking when it comes to investment is to automate the process.

Investment apps – and some budgeting apps that have an investment function – can instruct your bank to make deposits automatically, with parameters set by the user.

This lets you take a ‘set and forget’ approach to investment, for example, by instructing the app to make a recurring purchase on a particular stock.

Because some budgeting apps have investment functions, you can even set things up so that, if you come in under budget on a particular month, the money is automatically moved from your current account to your savings account or invested.

How to use open banking safely

Open banking is safe.

Payments NZ has established a set of security standards that banks and third parties must comply with to participate in open banking.

For a bank to grant another party access to your financial information, both must meet the Payments NZ standards. So, if you’re using a bank and a registered third party, you should be safe.

However, criminals will exploit a victim’s lack of knowledge or understanding to get at their money, as we know from our work on scams.

To stay safe, before you engage with a company claiming to use open banking, check whether they’re a regulated provider with an agreement with your bank.

ANZ, ASB and Westpac all provide this information on their websites.

Payments NZ’s API centre can also tell you whether a third party participates in the secure open banking system.

The usual rules of protecting yourself from scams still apply

Scammers may mention ‘open banking’ to encourage victims to hand over personal information, but the usual rules for protecting yourself from scams still apply.

Be suspicious of spontaneous contact. If a business, or your bank, calls you out of the blue, it’s better to be safe than sorry. If you’re suspicious, put the phone down, find the number independently and call them back yourself.

Resist urgency. Scammers use urgency to stop people making thoughtful decisions. If you receive a text from someone you know asking you to take urgent action – for example, from a family member telling you they’ve run out of money – try to pause and contact the person at their normal number.

Protect your personal information. Be careful when you’re asked to provide personal information, particularly if you haven’t initiated the call. Legitimate businesses will never ask for your password, and security checks should only seek enough information to confirm your identity. If someone calls and asks a lot of personal questions, this is a reason to be suspicious. If in doubt, hang up, find the number yourself and call back.

If it’s too good to be true, it is. If an offer seems too good to be true, it probably is. The distant relative you’ve never heard of did not bequeath you $1 million. The lover you have met online but never in person does not need $200 to make it to payday. You do not need to give your online cryptocurrency friend $100 to unlock the opportunity of a lifetime. Sorry!

Stamp out scams

Scams are on the rise, with over a million households in NZ targeted by scammers in the past year. Help us put pressure on the government to introduce a national scam framework that holds businesses to account.