By Ruairi O'Shea

Former Investigative Writer | Kaituhi Mātoro

When Katie* and her partner bought their first home, they wanted to invest in some security cameras to protect their property.

“My partner saw there was a sale on the cameras we wanted at PB Tech. Because it was around Christmas, and that’s a bit of a tough time, we used Afterpay to spread the cost.”

But when Katie looked at the invoice for the cameras, she saw something unusual. PB Tech had imposed a 1% surcharge – which came to $8.62 – on their purchase.

“I thought it was strange that there was a surcharge. I’ve used Afterpay since it first started, and I’ve used it with other retailers, and I’ve never seen a surcharge,” Katie said.

Katie asked PB Tech about the surcharge. The retailer told her that, as part of its agreement with Afterpay, it is permitted to apply a small surcharge to payments made using Afterpay.

So, Katie followed up with Afterpay.

Afterpay said she should contact the retailer for a refund and told her they would investigate the surcharge. When PB Tech refused to refund her, Afterpay credited Katie's account as a “goodwill gesture."

So where does Afterpay stand on surcharging? Are businesses allowed to surcharge customers for using Afterpay, and if so, if customers have to pay a surcharge for using the service, is the service free as Afterpay claim?

Can businesses surcharge customers for using Afterpay?

Retailers can impose a surcharge on customers for using Afterpay, but they cannot do this without Afterpay’s agreement.

The language around surcharges is clear in an example merchant agreement on Afterpay’s website:

“You must not impose a surcharge on the customer or discriminate against the customer in any way for using Afterpay as a payment mechanism … For example, you must not charge the customer a fee in addition to the sale price (and any applicable shipping costs) on the basis that the customer has elected Afterpay as their chosen payment method.”

When Consumer NZ asked Afterpay about this agreement, it told us that “surcharging arrangements can be merchant-specific as there may be cases where a merchant surcharges all payment methods.”

We think Afterpay’s “free to use” claim is misleading

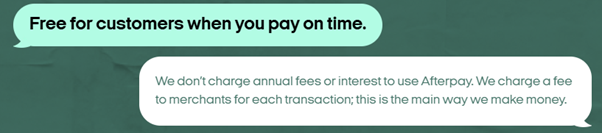

Afterpay’s website repeatedly claims the service is free to use when customers pay on time.

In explaining the business model, the website says, “We don’t charge annual fees or interest to use Afterpay. We charge a fee to merchants for each transaction; this is the main way we make money.”

Afterpay claims that its service is free, as long as customers keep up with their payments, but PB Tech customers are being charged every time they use the service. In Katie’s example, using Afterpay wasn’t free: it cost her $8.62.

And the same 1% surcharge will apply to anyone using Afterpay at PB Tech.

We believe this practice is misleading and is likely to breach the Fair Trading Act, which prohibits traders from engaging in misleading and deceptive conduct.

We put this claim to Afterpay. They said:

“Afterpay does not charge customers who pay on time. Surcharging is very uncommon across all merchants, but may be permitted in some rare and specific circumstances. For example, when a merchant has surcharges associated with other forms of payment like Visa or Mastercard.”

Afterpay say that they do not charge customers, but by allowing PB Tech to impose surcharges, their customers are paying to use the service.

Consumer will be making a complaint about Afterpay’s conduct to the Commerce Commission.

This is not the case for PB Tech, which offers online eftpos and POLi as surcharge-free payment options.

However, a retailer can come to an agreement with Afterpay that allows them to impose surcharges. We asked PB Tech about this. PB Tech said:

“We're permitted to apply a small surcharge to cover the transaction costs associated with this payment method. This practice complies with our contractual obligations and the terms set forth by Afterpay … We are not aware of any legislation this practice breaches, and we're confident that our practices will be found to be compliant with relevant regulations and the terms of our agreement with Afterpay.”

And when we asked Afterpay about its agreement with PB Tech, it said:

“Surcharging is not common but may be permitted in some specific circumstances. We are not aware of a situation where surcharging is occurring when it is not permitted.”

So, what does this mean for Afterpay’s claim that its service is free as long as you keep up with payments?

Have you been surcharged for using Afterpay?

If you’ve been surcharged for using Afterpay, we’d love to hear from you, but we’d also recommend you contact Afterpay directly.

Afterpay will be able to tell you whether the retailer in question has surcharged you in breach of their merchant agreement or, if instead of being free, you’ve been charged for using the service with Afterpay’s permission.

If you’re planning on using Afterpay, we’d recommend you follow Katie’s advice.

“Just be careful about surcharges when you’re choosing a payment method; check your receipt once you’ve made your purchase and stand up for yourself if you’ve been surcharged.”

*Name changed to protect privacy

Better protection for Buy Now Pay Later users

We need Buy Now Pay Later regulations to stop irresponsible lending.