By Sahar Lone

Former Communications and Campaigns Manager | Kaiwhakahaere Whakapā, Kaupapa

New Zealanders tend to stand by their KiwiSaver providers, even when the numbers suggest they shouldn’t. It’s the kind of loyalty that would make Dave Dobbyn proud. But if it’s not in your best interest, it could be time to change your financial tune.

On this page

- Many of us stick with the big bank KiwiSaver providers out of habit

- Consumer NZ’s annual KiwiSaver satisfaction survey results

- Convenience trumps comparison for bank scheme members

- People’s trust in banks

- What people want from their KiwiSaver provider

- The importance of KiwiSaver in our financial future

- Money chats: how to have them

- Maybe it’s time for a KiwiSaver change or two

Big banks attract the lion’s share of KiwiSaver accounts in this country. Arguably, they retain so many accounts by being the devil people know through familiarity, even if better alternatives exist. According to ad monitoring report, Nielsen Ad Intel 2024, banks are the third-largest industry in terms of advertising spend, investing $180 million annually.

Leading the big bank advertising charge is the largest KiwiSaver provider, ANZ. It has the sixth-largest advertising budget. Yet, ANZ, has proved to be one of the worst-performing KiwiSaver providers when it comes to returns. Over 10 years, it has come in last (12th) for its management of conservative KiwiSaver funds, 6th out of 12 for moderate funds,14th out of 15 for balanced funds and 10th out of 12 for growth funds, according to investment research company Morningstar’s December 2024 results.

In 2021, ANZ and ASB lost their status as default KiwiSaver providers with the Financial Markets Authority (FMA). This left BT Funds (Westpac) and BNZ as the only default big bank providers for new KiwiSaver members. Kiwi Wealth, formerly owned by Kiwi Bank, is now owned by Fisher Funds, making Fisher Funds the third-largest KiwiSaver provider. Despite its poor performance, ANZ holds its place as leader on the KiwiSaver provider board, holding nearly $22 billion (18% of total KiwiSaver funds), followed by ASB, Fisher Funds, Westpac and Milford.

Many of us stick with the big bank KiwiSaver providers out of habit

I’ve banked with ASB since childhood. I still remember the yellow plastic elephant, Kashin, ASB gave to primary school aged children. It was a different time. Back then, plastic toys were prized, and the bank even bought a real Asian elephant for Auckland Zoo. Its marketing directly to kids was a clever way to build a customer pipeline for life.

So, when I started working, I stuck with ASB and joined one of its KiwiSaver schemes. I tracked all my balances online, followed advice from personal finance journalist Mary Holm to adjust my fund type at different life stages and occasionally paid attention to returns.

What encouraged me to finally leave ASB’s KiwiSaver scheme was a realisation that it was offering lower returns compared to other providers I looked at. For example, over five years, Booster’s Geared Growth Fund delivered 8.47% returns, after fees and taxes, while ASB’s Growth Fund only returned 6.28%.

Consumer NZ’s annual KiwiSaver satisfaction survey results

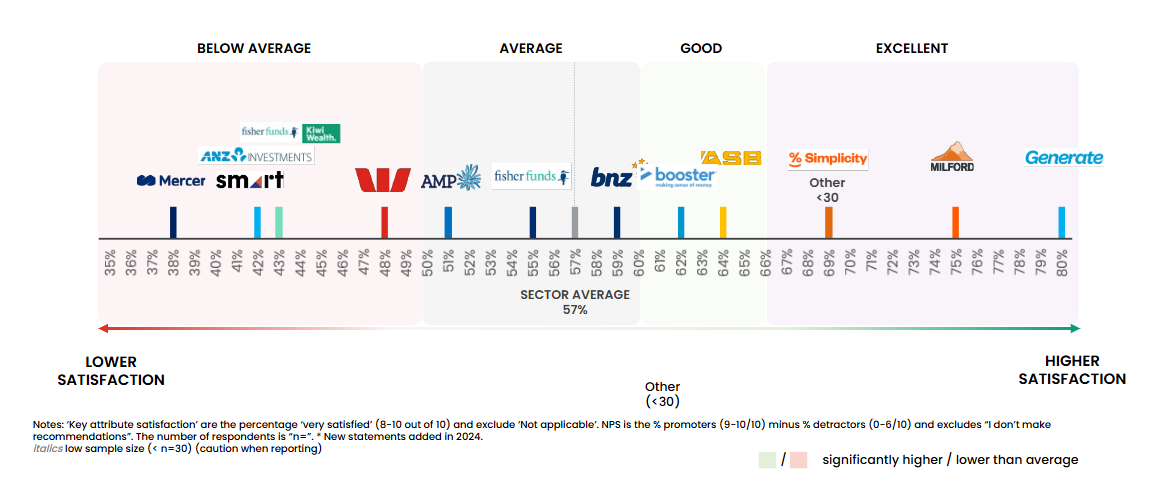

Consumer NZ’s annual KiwiSaver satisfaction survey results to February 2025 highlight growing satisfaction over the past year (82% compared with 80% for the same 2024 period).

The satisfaction is partly driven by improved investment returns and fewer reported problems. This is despite the largest provider, ANZ, performing poorly and getting worse year on year. Satisfaction amongst ANZ KiwiSaver members we surveyed was at 76% in 2024, declining to 73% in 2025. Overall, investment returns remain the strongest driver of satisfaction for KiwiSaver members.

Convenience trumps comparison for bank scheme members

Which of the following best describes how you have chosen your current KiwiSaver scheme?

by Bank/non-Bank KiwiSaver providers

People’s trust in banks

In a different Consumer survey, the trust score for banks was 26% and KiwiSaver was 48%. This suggests people generally trust KiwiSaver providers more than they trust banks. This might help explain why they stay with underperforming schemes longer than they should.

I seem to be part of the trend of people leaving their bank KiwiSaver provider. In the Consumer banking and KiwiSaver survey, 18% of participants who switched their bank provider also left one of ASB’s KiwiSaver schemes.

When we look at satisfaction, banking providers tend to score lower than non-bank KiwiSaver providers.

9% of bank KiwiSaver members said they wanted better KiwiSaver advice. Only 5% of non-bank members said the same. That may be because non-bank providers are doing a better job, or maybe their customers are more self-directed.

The two comparison tools I used

When comparing providers, two tools came in handy.

The Sorted Smart Investor tool was the tool I used to compare the fund types I was interested in, looking at net results over the long term. Although, financial advisors warn that historic results might not reflect future performance and encourage people to seek tailored advice to suit their individual needs.

Mindful Money was the tool I used to compare the ethics of different schemes. For me, ethical means not wanting my KiwiSaver investments to be funding illegal Israeli activity in Palestine and the arms trade.

Turns out, I’m not alone in wanting my money to be invested responsibly.

What people want from their KiwiSaver provider

When asked what people want from their provider – returns, responsible investments, low fees.

Making the switch was quick and painless, and the only immediate downside was no longer being able to see my KiwiSaver balance when I logged into online banking.

The importance of KiwiSaver in our financial future

Demographer Paul Spoonley projects that by 2033, over 65s will make up 22% of our country’s population. This surpasses the 20% threshold for an ‘aged society’.

The Guardians of the New Zealand Superannuation Fund expects pension payments to roughly double to $44 billion by 2036. Cumulatively, both superannuation and KiwiSaver will have a significant impact on our financial wellbeing in the later years of our lives. KiwiSaver, established by the government in 2007, encourages New Zealanders to save for retirement. It includes the option to use savings for a first home or in times of hardship. It might represent a large portion of a person’s retirement savings, so being in a KiwiSaver scheme that is performing well and suitable to your life stage is crucial.

As of the end of 2024, over 3 million people had put in more than $120 billion to the funds under management in KiwiSaver.

Money chats: how to have them

Talking about money can be taboo, but it’s essential for our financial wellbeing. The key is knowing who to take advice from. Friends and family may be able to offer helpful suggestions. However, financial advisors will encourage you to seek professional financial advice that is tailored to your unique circumstances and needs. This includes your risk tolerance, life stage, earnings, investment mix and retirement goals.

Evaluating your KiwiSaver’s performance is something worth doing annually. However, some providers charge small fees when you leave their schemes, and financial advisers warn against switching to a conservative fund due to market volatility unless you plan to withdraw your funds soon, such as buying your first home within the next year.

Maybe it’s time for a KiwiSaver change or two

When it comes to your finances, it’s worth questioning whether sticking with the status quo is the best option for you.

As the Dave Dobbyn song continues, “If I could see your heart right now, maybe there’d be a change or two.” We shouldn’t be loyal just out of habit. Loyalty should come because it aligns with our best interests. So, maybe it's time to stop singing Loyal in the face of poor returns and follow a financial strategy that works for you.

Best and worst KiwiSaver providers

See what customers think of the 13 major providers in our survey.