By Rebecca Styles

Research Lead | Hautū Rangahau

On this page

- A dodgy deal?

- The costly add-on insurance products

- Big commissions for the car yard selling add-on products

- The finance company can deactivate the car if you don’t pay

- Jimmy ditches the deal

- Complaints against Go Car Finance’s ‘systematic irresponsible lending’

- Car finance deals: what needs to change

By Rebecca Styles, research team leader, and Imogen Wara, community journalist.

Need to know

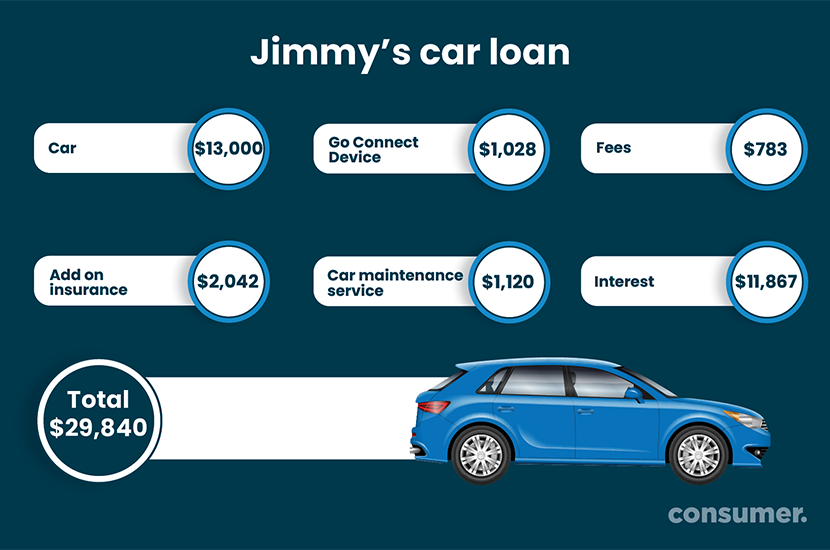

Go Car Finance charged Jimmy nearly $30,000 for a four-year loan, including add-ons and an interest rate of 29.96%.

Add-ons are driven by commissions, with dealers and finance companies earning on average $421 for mechanical breakdown insurance (MBI) and $304 for guaranteed asset protection (GAP) insurance.

We think Go Car Finance is likely to have breached its obligations under the Credit Contracts and Consumer Finance Act (CCCFA) and the Commerce Commission is currently investigating.

Your consumer rights: insurers and car yards must make you aware of your rights and what products you are buying when purchasing car finance under the CCCFA. The Fair Trading Act (FTA) also prohibits dealers and lenders from making false or misleading claims. If you believe you have been mis-sold finance or add-ons, contact the Commerce Commission.

In December last year, Naenae-based Jimmy travelled to Hamilton to pick up a car.

Jimmy had been looking for a vehicle for a while. He wanted to start a second job making deliveries for DoorDash while also working full-time at Elysian Foods in Petone. However, Jimmy had a bad credit score and was struggling to get finance.

One day he stumbled across a Gem Cars ad on Instagram offering finance for people with bad credit scores.

“I do see a lot of ads like that, and I’m like, ‘no that probably isn’t a good idea,’ but it’s just how they formatted it. It was like I went into it curious,” Jimmy told Consumer.

After filling out an online finance application through Gem Cars’ website, Jimmy received a text from the salesman. He asked Jimmy to provide bank statements from the previous three months, along with proof of his employment and driver’s license to complete the finance application.

Four days later, Jimmy received a text message confirming his loan had been approved. However, he was told there was only one car available for him to purchase on finance - a 2007 Toyota Blade Hatchback (115,800kms). He could take it or leave it. He wasn’t told the price and had to ask for the vehicle specs and photos.

Jimmy was so eager to get a car after many fruitless searches that he agreed to buy the Toyota and completed the paperwork online. No one at Gem Cars or Go Car Finance went through the terms and conditions of the contract with him.

Although Gem Cars advertises nationwide delivery on its website, when Jimmy requested it, he was told it wasn’t covered by the loan, and would cost him $600-$700. Jimmy decided to fly from Wellington to Hamilton to retrieve the car and drive it back.

Once Jimmy arrived at the car yard he was met by the salesman. “He let me inspect [the car], and he gave me the [finance] booklet and paperwork ... told me everything I needed to know was in the booklet, gave me the keys and that was it,” Jimmy explained.

A dodgy deal?

The car cost Jimmy $13,000. Yet the Trade Me car valuation tool priced the vehicle at around $7000. Gem Cars told us it paid more than $7000 for the car.

What is also shocking about Jimmy’s experience was the number of extras added to his finance deal along with a high interest rate that would add up to nearly $30,000 over the four-year period of the loan.

How on earth can a finance deal on a second-hand car end up costing so much?

Our team went over the details of the car finance deal and the car sale itself. We found a range of issues that set off alarm bells.

The fact Jimmy was told only one car was available for him to purchase is concerning. Surely it wasn’t his only option in a car yard full of vehicles.

We think Go Car Finance is also likely to have breached its obligations under the Credit Contracts and Consumer Finance Act (CCCFA). Under the CCCFA, lenders must exercise the care, skill and diligence of a responsible lender. This includes making sure loans are both suitable and affordable for the borrower.

Although Go Car Finance, through Gem Cars, appears to have checked the loan would be affordable for Jimmy, we haven’t seen any evidence suggesting it checked the suitability of the loan.

Under CCCFA regulations, lenders also must check whether a borrower wants any fees and charges associated with the loan included in the loan or paid separately. Paying separately means those charges don’t attract interest over the duration of the loan. We haven’t seen any evidence of Jimmy being given these options.

Plus, we believe Jimmy wasn’t given all the information he needed to make an informed decision about whether to enter the loan agreement. Another likely breach of the CCCFA.

Gem Cars also sold Jimmy a lot of extra products that he can’t remember discussing, let alone agreeing to purchase, which are poor value, such as add-on insurances. We think Gem Cars misled Jimmy about these products, breaching the Fair Trading Act (FTA).

All in all, the deal appears so dodgy, it could be regarded as unconscionable conduct, which is also prohibited by the FTA.

A spokesperson for Gem Cars said Jimmy was sent the paperwork and talked to the salesperson about fees, insurance and interest. Yet, Jimmy has no recollection of the discussion.

It also refutes the allegation it breached the FTA because it said the insurances were disclosed by the salesman.

In a statement, Go Car Finance said it gave all the information Jimmy needed to make an informed decision about the loan and related fees. “[We] maintain our position that we meet our obligations under the CCCFA and Responsible Lending Code,” a spokesperson said.

The costly add-on insurance products

Although the car yard stated on the loan paperwork that Jimmy didn’t need any add-on insurance products, a mechanical breakdown insurance policy (MBI) and restart waiver totalling $2042 were added to the deal.

Mechanical breakdown insurance (MBI)

The three-year MBI policy covers any unforeseen mechanical or electrical faults. It also covers emergency breakdowns away from home, however, cover only applies if the breakdown happens 120km away from home, and the repair takes longer than 24 hours. You’ll also need evidence of the car being regularly serviced. These policies don’t usually offer any more protection than what is covered under the Consumer Guarantees Act (CGA).

The fact that Jimmy wanted to use the vehicle for food deliveries may have excluded him from cover.

“Our policies do not cover taxis, rental or goods vehicles due to the extreme high mileage these vehicles travel,” the Provident spokesperson said.

Restart waiver or Guaranteed Asset Protection (GAP)

The restart waiver will cover the shortfall between the loan balance and the insurance payout if the vehicle is a total loss. Other providers called this product Guaranteed Asset Protection insurance (GAP). However, a condition of the policy is that you have comprehensive insurance. If you don’t - you won’t be covered.

So, if you have an accident, and the car is written off, you would still have to repay the loan for a car you no longer have.

Go Car Finance said dealers will take the consumer through the insurance products so they understand what they’re buying. However, Jimmy wasn’t aware of these products, nor did he have them explained to him or agree to buy them.

Maintenance plan

Jimmy was also charged $1120 for a “maintenance package” for the vehicle over the four-year duration of the loan.

It included an annual WOF check, three vehicle safety checks, rego, and roadside assistance. On Jimmy’s contract it also included 12-monthly bronze servicing, but we couldn’t find any mention of what that meant in the product booklet.

Over four years, it’s likely you’d spend over a grand on WOF, rego and service checks. Yet, it would be better for Jimmy to pay for these expenses as they arise rather than add it to the loan and pay interest on it. Although Go Car told us that people don’t pay interest on this product, the way the loan agreement is formatted, it appears it was added to Jimmy’s loan.

Big commissions for the car yard selling add-on products

Both dealers and finance companies make a tidy sum selling add-on insurance products with car sales.

Over the 2020 financial year, the Commerce Commission found that the average commission on an MBI policy for car dealers was $421. For payment GAP insurance (which Go Car calls a “restart waiver”) it was $304.

And yet, not many people claim on the policies. While over $100m was spent on MBI policies by consumers in 2020, only $40m was paid out on claims.

The numbers are also dire for GAP insurance. While consumers spent nearly $14m on the policies in 2020, just under $2m was paid out, according to the Commerce Commission.

On top of the kickbacks for selling add-on insurance, dealers are also likely to get a “dealer referral fee” from the finance company for processing the finance application. These fees are usually passed on to the buyer along with an establishment fee to set up the loan. These combined costs added $471 onto Jimmy’s loan.

The finance company can deactivate the car if you don’t pay

Included in the extras Jimmy was charged was $430 for a Go Connect Device. The device is a GPS installed in the car and operated by the car finance company. It’s marketed as a tool to link your car to the Go Car App, allowing you to track your vehicle at all times.

However, if you’re late with a payment, the finance company can use the device to deactivate the engine, meaning the car won’t start.

Go Car will text you if you’ve missed a payment and give you a grace period to pay before the car is deactivated. But, if you don’t stump up with the money, you won’t be able to drive the car.

So, you could find yourself stranded in a supermarket carpark, or unable to get out of your driveway to get to work.

While Go Car will restart your car in an emergency and keep it going for three hours, you can only do this six times over the duration of the loan.

A spokesperson for Go Car said it makes several attempts to contact customers “before immobilising the vehicle” and “in many circumstances” it gives customers more than six emergency restarts.

It also said it will now only immobilise a car when it’s parked at a residential address, “preferably the customer’s home address.”

In its report about unethical practices in vehicle finance, Christians Against Poverty (CAP) call these devices “punitive and bullying” and a “degrading” way to stop people defaulting on their loans. We agree.

While a GPS can be helpful tracking a stolen car, in all cases that CAP see, it’s used to ensure people pay their loan on time.

It also found that those paying the highest interest rates – like the 29.95% Jimmy was paying – would have the GPS installed in the car.

Although the GPS device is solely for the benefit of the finance company, it’s the borrower paying for it, said CAP.

This was true for Jimmy, too. Not only was he charged for the device, but he would’ve also had to pay a monthly fee ($11.50). In total, Jimmy would spend $1028 on a device that we think only benefits Go Car Finance.

In total, Jimmy was charged $4973 for insurance and other extras on top of the loan for the car ($13,000).

Jimmy ditches the deal

When Jimmy returned to work with his new car, his manager and qualified accountant, Toby Green asked about it. When Toby heard how much money Jimmy had spent, he asked if he could look over the contracts.

Toby was shocked at the deal Jimmy had signed up for, as well as the amount of add-ons Jimmy had been conned into buying on finance; many of which Jimmy had no understanding of due to lack of disclosure and information.

“I’ve been through [the contract] a number of times. The number of things in there that you have to unravel are incredibly complex… [The average consumer] would have no hope in trying to untangle that mess,” Toby told Consumer.

Toby wrote a letter that Jimmy could send to Gem Cars to request termination of the contract during the five working day cooling-off period that borrowers have under the CCCFA – again, something Jimmy had not been made aware of.

Thankfully, Jimmy got a full refund. However, he had to pay $500 to return the car to Hamilton.

“It was quite a traumatic experience. It took a while for me to process it, but I decided to put my pride aside, put my face out there to help other people know and not fall for the same thing,” Jimmy confided.

“The scary thing about it was when I went up to Hamilton and met the salesman. He was very nice, charming, very friendly […] it just didn’t feel like he was trying to be malicious… I guess it’s just how good they are.”

Complaints against Go Car Finance’s ‘systematic irresponsible lending’

Jimmy isn’t alone in his experience.

A group of financial mentors around the country, from social agencies such as the Salvation Army and CAP, have complained to the Commerce Commission (the Commission) about Go Car Finance’s “systematic irresponsible lending.”

The Commission has received 33 enquiries about Go Car Finance, last year, on top of 23 received in 2021.

It opened an investigation in Go Car Finance in October 2021 in response to alleged breaches of the Credit Contracts and Consumer Finance Act 2003.

Louise Unger, general manager of the credit branch, said that because “the investigation is ongoing, we are unable to provide any further information at this stage, including when the Go Car Finance investigation is likely to be concluded.”

However, Unger confirmed it’s prioritising the investigation.

Go Car is owned by Australian corporation Money3. In its 2022 annual report, Money3 stated that Go Car Finance had 59.3% revenue growth to $50.8 million. And have $190.8m worth of loans on their books.

The Money3 group, which includes two lenders in Australia and Go Car Finance, had a net profit (after tax) of $51.6m.

Car finance deals: what needs to change

While the Commerce Commission did review motor vehicle financing and add-ons in 2020, financial mentors are not seeing any obvious improvements in the industry.

Christians Against Poverty are calling for an investigation into the vehicle finance sector to ensure consumers are protected from the financial harm of the current model.

They also want to see changes in how car finance and the numerous add-on products are sold including the following:

Introducing a ban on car dealers deciding on the interest rate for finance deals.

Setting limits on the amount of commission a car dealer can earn from selling add-on insurance products.

Stopping payment for add-on insurance products being rolled into the finance deal. This would mean consumers aren’t paying interest on the add-ons. CAP also believes that rolling the cost into the loan means consumers don’t really know what they are buying and can’t review their insurance commitments.

Implementing a four-day pause between the promotion and sale of add-on insurance products.

Banning immobiliser devices.

Reducing the amount of interest that can be charged on loans. The current cap is 0.8% per day.

We support CAP, and other community financial mentors, in their calls for change to how car finance and add-on products are sold.

Public Interest Journalism funded through NZ On Air

We can't do this without you.

As an independent non-profit, we depend on the generous support of our members and donors to keep us fighting for a better deal.