By Chris Schulz

Investigative Journalist | Kaipūrongo Whakatewhatewha

Since the death of Fly Buys, companies have been rolling out their own loyalty programmes, offering points, perks, specials and rewards to lure in customers. Should you really sign up for all those schemes? We take a closer look.

Samantha* shakes out her wallet. The receipts fall out first, then a couple of coins, followed by cards, one after the other. "I have Everyday Rewards, Airpoints, Farmers Club, the AA," she says. There's one for her pharmacy, another for a gardening store, several for different petrol stations. "Here's another Airpoints card. Which one is better? I don't know."

She keeps going, pulling them out, then counting them up till she gets to double figures. She's signed up for even more loyalty programmes at stores that didn't give her a card: a furniture store, a clothing chain, a shoe shop she's only ever bought one pair from, a painting and renovating supplies store, and the place she likes to get a regular massage. "I give them my phone number, and they add up my points," she says.

Samantha is signed up to so many loyalty programmes she can't remember them all. She does this for one reason: rewards. "At Farro, you get a free coffee on your birthday. With Cinebuzz, every now and then, you get a free movie … at Farmers, every now and then I get a $20 voucher," she says. “I bought some big-ticket furniture from Nood, and that was worth it – I got a $90 credit.”

By the time she's through, Samantha has tallied up more than 20 companies that now have her name, her phone number, her email address and many other personal details, including her shopping habits and purchase history, all because she’s been offered small and sometimes insignificant discounts, cash backs, specials or other rewards.

Even Samantha seems shocked by how many schemes she's signed up for. "When you shop online, they already have your details, so you get signed up," she says. Everyone, it seems, is suddenly clamouring for consumers like Samantha to join their loyalty programmes. Why?

The proliferation of points

"Do I have these things myself? Absolutely," says Bodo Lang. The Massey University professor of marketing opens his own wallet and starts taking out cards to prove it. He holds up cards for BP and Mobil, and one for his local sushi shop St Pierre's, which occasionally scores him a free lunch. "It just makes sense," he says.

Consumer NZ has organised a video chat with Lang to find out why loyalty cards exist. They began, he says, for one simple reason: companies wanted to retain their customers and dished out treats to encourage them to come back. “It's cheaper to retain customers than it is to acquire customers,” he says. “You want to hold on to your customers as much as you can.”

Over time, though, loyalty cards have evolved. These days they’re used to retain customers – and maximise how much they’re spending. Whether you’re shopping locally, or heading away on holiday, the rationale is you’re likely to revisit the same supermarket chain or petrol brand so you can keep earning rewards. You might spend more too. "You’re already in their store, so you're most likely to buy more or buy the more expensive version of whatever you're buying,” says Lang.

He agrees there are more of these schemes around than ever. And there’s a big reason for that: the death of Flybuys.

Across three decades, the Flybuys programme grew into Aotearoa’s biggest, with nearly three million users and a multitude of companies and rewards tied into the scheme. But Lang said the rewards landscape had changed, with “consumers perceiving Flybuys rewards as taking too long to attain”. It closed at the end of 2024.

Instead, a swathe of individual loyalty programmes tied to particular brands have taken Flybuys’ place. “The big provider has fallen away,” says Lang. “But it’s still a sensible thing to offer a discount to entice people back … the numbers still add up. And I think more and more businesses are waking up to that.”

There’s another advantage to running your own loyalty scheme too: data.

The dark side of loyalty

Recently, a Consumer reader got in touch with us to complain about her Everyday Rewards card, a membership programme used by 1.9 million Woolworths customers.

She said she hadn’t been receiving “boosts” – a tier of specials available only to cardholders. She was told, “boosts are automatically sent out to customers once we have a pattern or track record of your spending at Woolworths … If there is no activity or not much for us to track, unfortunately not much offers will be sent.” [sic]

Woolworths admits boosts are based on customers’ shopping habits, showing how companies are tracking customer behaviour more than ever before. This is a big concern, says Lang. “Data is power. Data is so important. Data gives you immense insights into what works and what doesn’t,” he says. That means testing out specials, or seeing how customers react to promotions, then tweaking them and further maximising profit. “It allows you to milk the consumer more effectively.”

In many cases, customer data will also be sold or shared with third parties: a 2020 Consumer investigation found most loyalty programmes were doing this. We believe companies need to be transparent and tell consumers when this technology is being used and how.

Lang says the more data companies have, the more effective their pressure tactics can be. He has a term for this – the “gamification” of consumption. Research shows it can work very effectively on some consumers, especially when promotions and loyalty programmes promote messages like, “The more you buy, the more you save”. Says Lang,: “Some consumers are really susceptible to this.”

‘The rewards have to be good’

Consumer investigated some of the country’s biggest loyalty programmes (see below) and found while some offered decent cashback, discount and reward deals, others were far less generous.

Two of our biggest supermarkets stood out as stingy: both Woolworths and New World offer just a $7.50 return per $1,000 spent. (The other major supermarket player, Pak’nSave, doesn’t have a loyalty scheme; it offers bonus points to ASB cardholders, and runs a Christmas Club scheme.)

In a recent survey, Consumer found widespread concern about supermarket loyalty programmes, with 38% of respondents finding them only slightly valuable or not valuable at all. Up to 29% had little to no trust in supermarkets pricing products and promotions fairly, and 26% believed supermarket discounts didn't represent real savings. Few felt loyalty programmes offered significant benefits. "Make loyalty rewards actually worth having and gaining,” suggested one. “Make meat, fruits, vegetables, dairy accessible and affordable.”

Spokespeople for Foodstuffs and Woolworths pointed out that loyalty programme customers can also access extra specials and other offers not available to non-cardholders.

Other programmes were more opaque. Instead of being tied to how much you spend, Air NZ’s loyalty programme awards Airpoints based on the route you’re taking and the kind of seat you’ve purchased. (For example, on a trip from Auckland to Sydney last year, I earned 2.6 Airpoints each way, but, just a few months later, a trip from Auckland to Wellington earned me 6 Airpoints each way.)

Others feel more generous. Cotton On offers a $10 voucher per $100 spent; Burger Fuel offers $15 for every $150 spent; and Farmers offers a $20 voucher once 250 points have accrued – although the number of points you receive varies depending on what you’re buying, and the vouchers only last for 3 months.

For Samantha, she says she’ll think twice about signing up to a loyalty programme the next time she’s offered the opportunity. She doesn’t have any room in her wallet for another card – and now she knows about how much of her data might be being used against her, she’s concerned about that too.

But if the rewards are good, she’ll definitely sign up. “I’ll see if there’s any value in it,” she says. “The rewards have to be good – that’s the main thing I’m looking at.”

*Not her real name.

Rack ‘em and stack ‘em

How do loyalty programmes stack up? We ran a ruler over the biggest to see if they’re worth it.

Airpoints

Points/value: Airpoints accrual is tied to flights, routes, and the type of fare a customer purchases.

Summary: Since May, 2024, I’ve made return flights to Sydney, Christchurch, and Wellington (four times) using Air NZ. I earned Airpoints on all these flights, plus for purchases at Mitre 10 and Z Energy. Tallied up, those purchases were worth thousands of dollars; yet they earned me just $36.09 in Airpoints credit. An Air NZ spokesperson said the airline amended some of its rates last year, and suggested customers use an affiliated credit card (American Express, ANZ, Kiwibank or Westpac) to accrue more points.

Everyday Rewards

Points/value: Woolworths’ loyalty programme, Onecard, was recently replaced by a different programme called Everyday Rewards. In addition to a swipe card, Everyday Rewards has an app, a new tier of specials and a points programme offering a $15 reward voucher for every 2,000 points accrued.

Summary: Without doubt, everyone wants to save money at the supermarket right now. But a recent Consumer survey found many items on "special" at Woolworths could be found cheaper elsewhere. We also have concerns around data harvesting. Everyday Rewards "boosts" are an example of harvesting in action, with "personalised offers" being presented to users to grow points faster. In the fine print, Woolworths says points expire after 18 months of inactivity, and reinstatement of points on lost, damaged or stolen cards is "at our discretion".

New World Clubcard

Points/value: New World’s loyalty programme, Clubcard, offers customers a 0.75% return, which at $7.50 per $1,000 spent works out about the same value as Woolworths.

Summary: A Foodstuffs spokesperson said the scheme had more than 1.8 million active customers and also offers giveaways, competitions, and the option to earn Airpoints. They said, “Customers receive New World Dollar rewards immediately after each shop, there is no requirement to reach a certain spend threshold to obtain rewards … Clubcard has helped New Zealanders save hundreds of dollars each year through Club Deals.”

Farmers Club

Points: A $20 voucher for every 250 points collected.

Summary: On the face of it, Farmers Club members are offered a decent return for using their card. But points don’t correlate to spend – beauty products offer 1 point for every $1, fashion offers 1 point for every $5, and home and Stevens products offer 1 point for every $10 spent. The vouchers are only valid for 3 months.

Card: Burger Fuel

Points: Burger “miles” are earned on every purchase; 150 miles earn a $15 voucher, which expires in 2 weeks. Free burgers are offered on birthdays, along with frequent freebies like fries or shakes.

Summary: Asked if a 2-week expiration date on vouchers was fair, a spokesperson replied,: “We have been live for just over a year and are in a learning phase. We have been reviewing customer and franchisee feedback and will be implementing the next phase of the programme in early April, which does include longer expiry periods for our core model rewards and more reminder notifications prior to rewards expiring.”

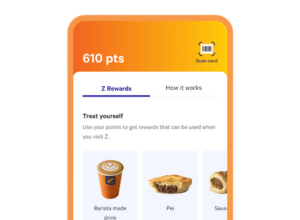

Card: Z Rewards

Points/Value: Instant 6c off each litre of petrol. Points earned for each purchase. Airpoints available too.

Summary: In an email sent to customers earlier this year, Z Energy said it would leave the Pumped loyalty programme on 5 March 2025, and discontinue coffee, car wash and LPG stamp cards. Instead, it was launching its own loyalty programme called Z Rewards. Any discounts accrued from 1 February would end on 5 March. Asked if that was fair, a spokesperson said, “It is not logistically feasible to transfer a customer’s stacked balance from the Pumped programme to Z Rewards. While we recognise this change means Z customers have a shorter period than they have previously had to redeem their stacked balance, this has been well communicated with customers to give them the best opportunity to redeem their balance.”

Card: Mecca Beauty Loop

Points/value: Rather than points, Mecca’s loyalty programme offers rewards based on how much is spent with the company in a 12-month period.

Summary: At level one, Mecca customers who spend $300–$599.99 a year earn four rewards and a birthday gift each year; at level four, customers who spend $3,500 a year receive nine rewards, a birthday gift, a makeup application and invites to exclusive events every year. In its privacy policy, Mecca admits it shares personal data with “affiliated or related companies”, “contractors, service providers and other third parties”, “professional advisers” and “any other person or organisation that we notify you about”.

Sick of misleading pricing?

Supermarket pricing errors are widespread. We need clear rules, stronger penalties and automatic compensation for shoppers when supermarkets get it wrong.

Find out about our campaign to force the supermarkets to price it right.