Under the Consumer Guarantees Act (CGA), your consumer rights are expressed as a series of guarantees that a seller automatically makes to you when you buy any goods or services for personal use. In this guide, we explain what those rights are, and what to do if you think your rights have been breached.

For advice specific to your situation, our members can contact our Consumer Advice Line. Our advisers will talk you through your rights and help you resolve problems with a retailer.

What it covers

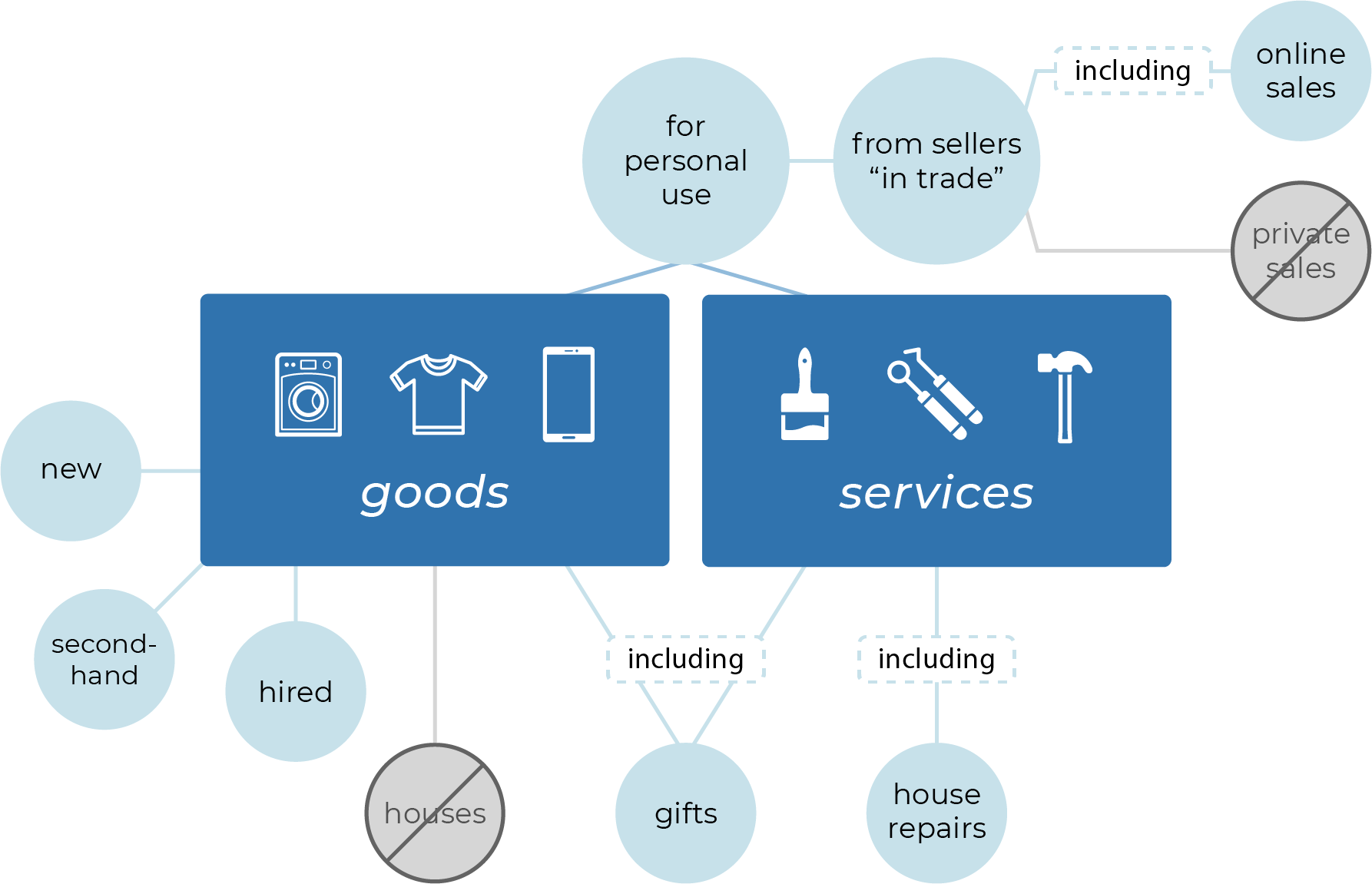

The act covers goods (new and second-hand) and services ordinarily purchased for personal, domestic or household use. “Goods” include pretty much everything in and around the home – from appliances to vehicles, furniture to food. Gas, electricity, water and computer software are also covered.

“Services” include things done by tradespeople such as plumbers and painters, professionals such as dentists and lawyers, after-sales and repair services from shops, and all the services you get from insurers, petrol stations and travel agents. In general, if you pay for it, it’s covered.

The act also applies to goods you hire and to gifts. If you’re given something, you have the same rights as if you bought it yourself, and can seek redress directly for any problem.

The act only applies if you buy goods or services from sellers “in trade”.

What it doesn’t cover

This means it does not cover private sales. However, it does cover goods sold in second-hand shops, and goods sold over the internet by businesses trading here.

The act does not cover the purchase of homes, although it does cover home repairs. Nor does it cover goods or services usually bought for commercial use, such as medical equipment or the installation of industrial machinery.

Sellers can’t contract out

Sellers cannot exempt themselves from their obligations under the act, even if they put it in a contract. So, if a retailer puts up a sign saying “no refunds or exchanges” it is meaningless. You still have full rights under the act.

This also means guarantees and warranties cannot state “no consequential losses are covered”, because attempts to contract out of the act may mislead consumers about their rights.

The Commerce Commission may use the Fair Trading Act to prosecute traders attempting to contract out of the act.

Sellers can only contract out of the act when goods are used for business. When a product is ordinarily purchased for domestic use but is used for business purposes – such as a mobile phone – the act will allow a seller to contract out. Any contracting out must be done in writing at the point of sale.

The guarantees

Under the act, your consumer rights are expressed as a series of “guarantees” a seller automatically makes to you when you buy any good or service ordinarily purchased for personal use.

Goods

Retailers and other suppliers guarantee their goods will:

Be of acceptable quality.

Be fit for a particular purpose that you asked about.

Match the description given in advertisements or sales brochures, or by the sales assistant.

Match the sample or demonstration model.

Be owned by the consumer, once purchased.

Be a reasonable price, if no price or pricing formula has been previously agreed.

Be delivered on time, where the supplier is responsible for delivery. When no time is agreed, delivery must still be within a reasonable time.

Manufacturers (the definition includes importers) in New Zealand guarantee that:

Spare parts and repair facilities will be available for a reasonable time.

They will honour any written warranty that comes with their products.

Goods are of acceptable quality.

Goods match their description.

Services

Service providers guarantee their services will be:

Performed with reasonable care and skill.

Fit for the particular purpose they were supplied.

Completed within a reasonable time.

A reasonable price, if no price or pricing formula has been previously agreed.

What is “acceptable quality”?

Acceptable quality means goods:

Do what they are made to do.

Are acceptable in appearance and finish.

Are free from minor defects.

Are safe and durable (i.e. last a reasonable amount of time).

The act’s terms “reasonable” and “acceptable” are deliberately open-ended.

It depends on what a reasonable consumer would think was acceptable based on the nature of the goods, the price, any statements that have been made about the goods, and the nature of the supplier and context in which the goods are supplied. A concert violin is required to meet a higher standard than a child’s cheap instrument. Ultimately a tribunal referee or a judge may have to decide what is reasonable or acceptable in the circumstances.

If a defect was pointed out to you before you bought the good, then it doesn’t count towards making it unacceptable.

We know your rights

Got a problem with a faulty product, received shoddy service or been misled by a retailer? Our expert advisers can provide clear, practical advice that you can trust.

Putting it right

If something goes wrong, you have the right to insist the seller fixes things.

Generally speaking, this means the retailer that sold you the goods or services must sort out the problem. If the stitching comes apart on your fairly new shoes, you don’t have to track down the manufacturer or importer, you simply take them back to the shop.

If the problem is minor, and can be fixed, the retailer can choose to either repair the item, replace it or give you a refund.

If the problem can’t be fixed, or can’t be put right within a reasonable time, or is substantial, you can:

Reject the product and choose a replacement of the same type and similar value or a full refund of your purchase price; or

Claim compensation for any drop in the value of the product or service.

Cancel the service contract, pay for any satisfactory work already done, and get someone else to finish the repairs; or

Have it repaired elsewhere and recover the costs from the retailer, if it refuses to fix a faulty product, or fails to do so in a reasonable time.

When you have the right to reject the goods, sellers cannot just offer a credit note. If you want a refund, you are entitled to it – by cash, cheque or credit card charge reversal.

Substantial means:

A reasonable consumer wouldn’t have bought the goods if they’d known about the fault.

The goods are significantly different from their description, sample or demonstration model.

The goods are substantially unfit for purpose.

The goods are unsafe.

In addition to these rights, consumers may also claim for any reasonably foreseeable extra loss that results from the initial problem.

Consequential loss

If your new washing machine won’t work properly you can claim for laundry costs or the cost of hiring a replacement machine while the first one is being fixed.

If you have to post or courier goods back to be repaired, you don’t have to pay for those costs.

The compensation for consequential loss must put you back in the position you would have been in if the goods or service hadn’t been faulty.

Replacement models are covered

When a faulty product is replaced, any manufacturer’s warranty on the product usually runs only from the original purchase date.

So, if a 6-month-old washing machine is replaced because it is faulty, and there was originally a 12-month manufacturer’s warranty on it, then this warranty will have 6 months to run on the new machine.

However, the Consumer Guarantees Act applies to the replacement, so you will still have all the rights you’re entitled to when buying a new machine.

When to complain to manufacturers and importers

If there is a problem with the retailer, you can complain to the manufacturer (if it has an office in New Zealand) or where the goods are imported, to the importer or distributor.

Where there has been a breach of the act, manufacturers and importers are obliged to:

Pay compensation, and/or pay for any loss in value; and

Honour any express warranty they gave that gives the consumer greater protection than the act.

Complaining to the manufacturer is useful when, for example, the retailer has gone out of business or is proving hopeless to deal with. But in most cases, it will be easier to insist on your rights directly with the retailer.

If a product has parts made by different manufacturers, you can claim against any or all of them. However, in practice your best bet may be to contact the one whose name is on the product.

Don’t be tempted by extended warranties

You’d probably be paying for protection you’re already entitled to under consumer law, your home and contents insurance, or the manufacturer’s warranty. In some cases, the extended warranty offers less cover than you’re entitled to under the law.

Our report on extended warranties explains the pitfalls.