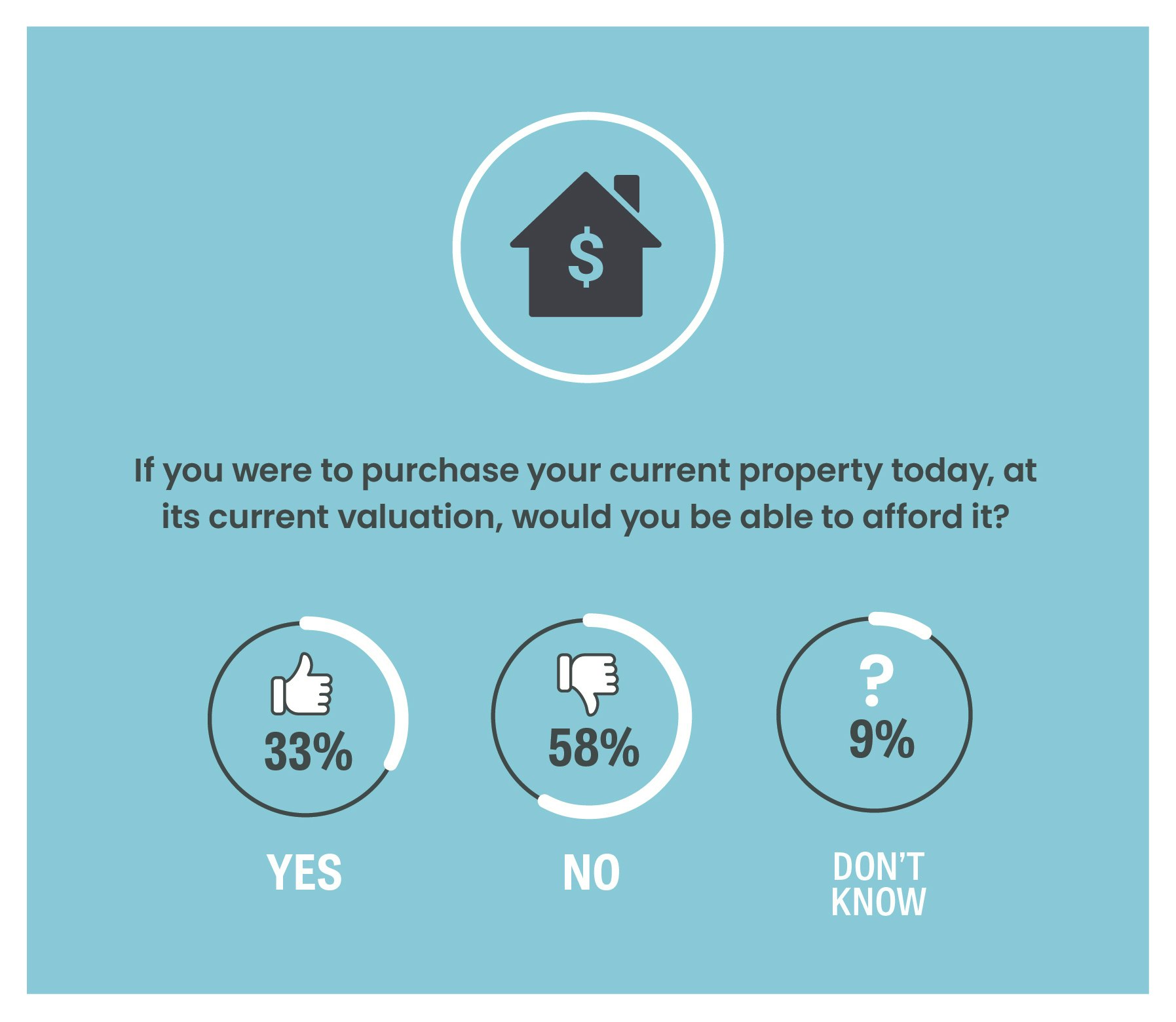

Results from our new Sentiment Tracker have found three out of five property owners would be priced out of their property if they had to purchase it at its current valuation.

Those aged 60-69 were least likely to be able to afford to buy the property (66%), followed by those aged 50-59 and those 70+ (59%). Approximately half of those aged 18-29 would still be able to afford their property.

At present, the average house price is more than 12 times the average national income. With skyrocketing house prices, many New Zealanders are finding it increasingly difficult to get their foot on the property ladder.

New Zealanders were asked what their biggest concerns are at present, and from both a national and financial perspective, the answer was housing. It exceeded concerns about Covid-19, as well as the cost of electricity and food. Regardless of whether New Zealanders own a home or are renting, they are deeply concerned about the state of housing.

James, a registered electrician from Whangārei purchased his home for $450k in 2018. Since then, the property’s capital gains have outstripped both his and his partner’s combined annual salaries.

“We really lucked out getting into the housing market when we did. Between the two of us we had 30 years of combined KiwiSaver – and some savings on top of that. When we bought the house, it was a massive relief that we wouldn’t be beholden to a landlord. It’s offered us peace of mind. If we’d acted a few years later, our home purchase would not have been possible.”

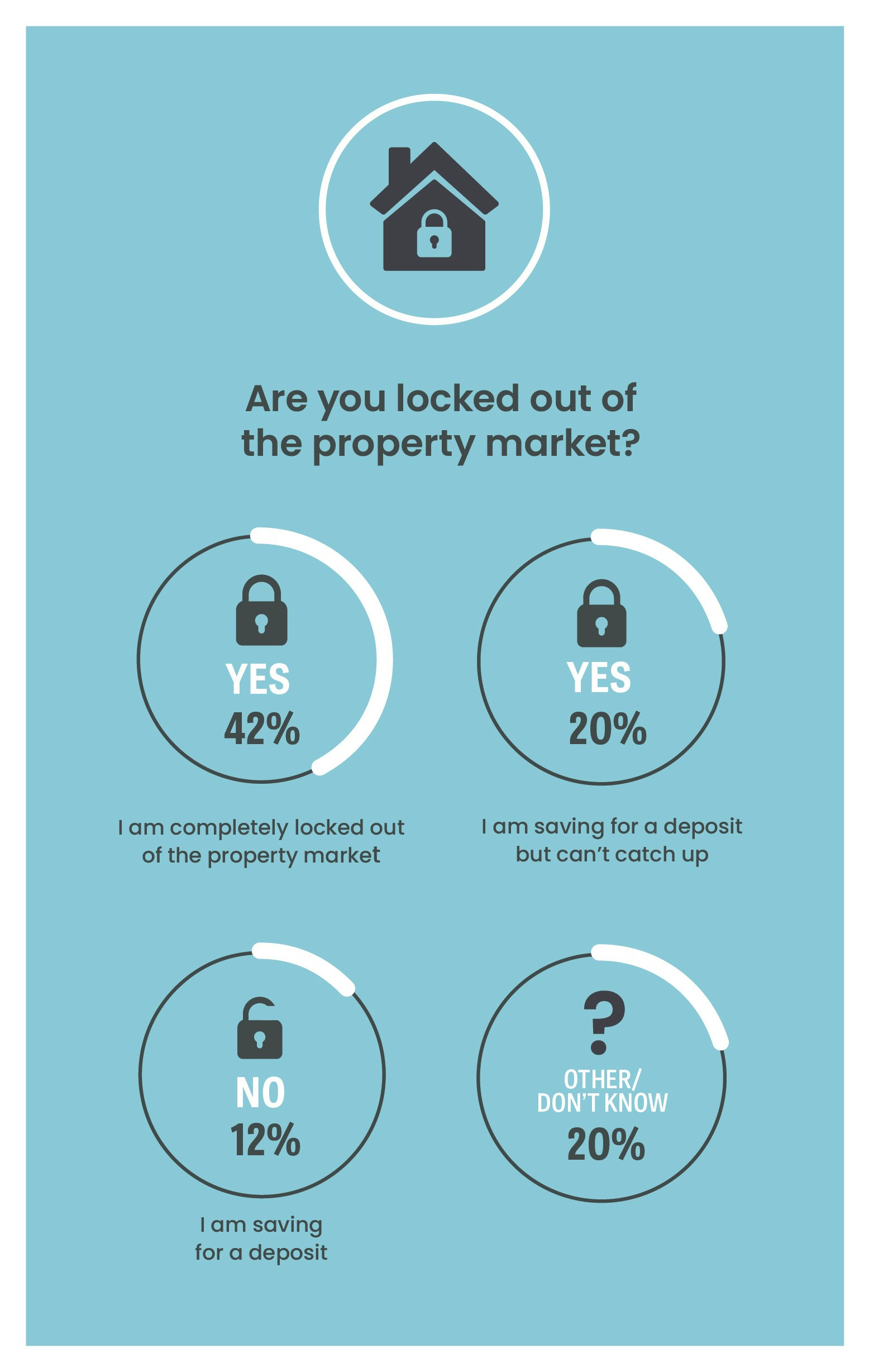

The Sentiment Tracker also asked New Zealanders who didn’t own property how they felt about their chances of purchasing a property. Forty-two percent felt completely locked out of the market. Twenty percent said they’re saving for a deposit but can’t catch up.

The Consumer NZ Sentiment Tracker is a nationally representative body of data that grows by more than 1000 respondents every three months. Tracking everything from environmental awareness and financial sentiment to general levels of trust for major industries – it looks to provide a holistic understanding of how New Zealanders feel about a range of issues.