By Jessica Walker

Communications and Campaigns Manager | Pou Whakahaere Whitiwhiti Kōrero, Kaupapa Whakatairanga

I have so many questions.

About 25 years ago, the electricity market, as we now know it, was born. With this birth came the promise of consumer choice and lower pricing. Sadly, that promise has not been realised. Residential electricity prices are a shocking 38% higher than they were in the late nineties. On the face of it, we have a competitive market because there are about 30 retail ‘brands’ to choose from. However, a huge percentage of New Zealanders, about 85% of us, have stuck with one of the original ‘gentailers’, a company that both generates and retails electricity. While those gentailers (Mercury, Meridian, Contact and Genesis) continue to enjoy their whopping market shares, new entrants to the market, who tend to have the most competitive prices and innovative offers, have struggled to grow their share. Why?

It's not because gentailers’ customers are deliriously happy with their electricity provider. So, why don’t people switch? The sad reality is that some literally can’t; they have no choice but to stick with their current retailer or start using prepay. Our latest Energy Retailer survey found that almost 1 in 10 New Zealand households had been turned down as a customer by an electricity retailer because of an unpaid bill.

In the depths of winter 2024, we heard from many people who were restricting their energy use, particularly their heating, in an effort to keep their bills down. The word we kept hearing was ‘struggle’. The rising costs and dropping temperatures led to a sense of despair.

Last winter, we reported that over 360,000 households had difficulty paying their power bills, and 2% of households had their power disconnected at least once because they couldn’t pay a bill.

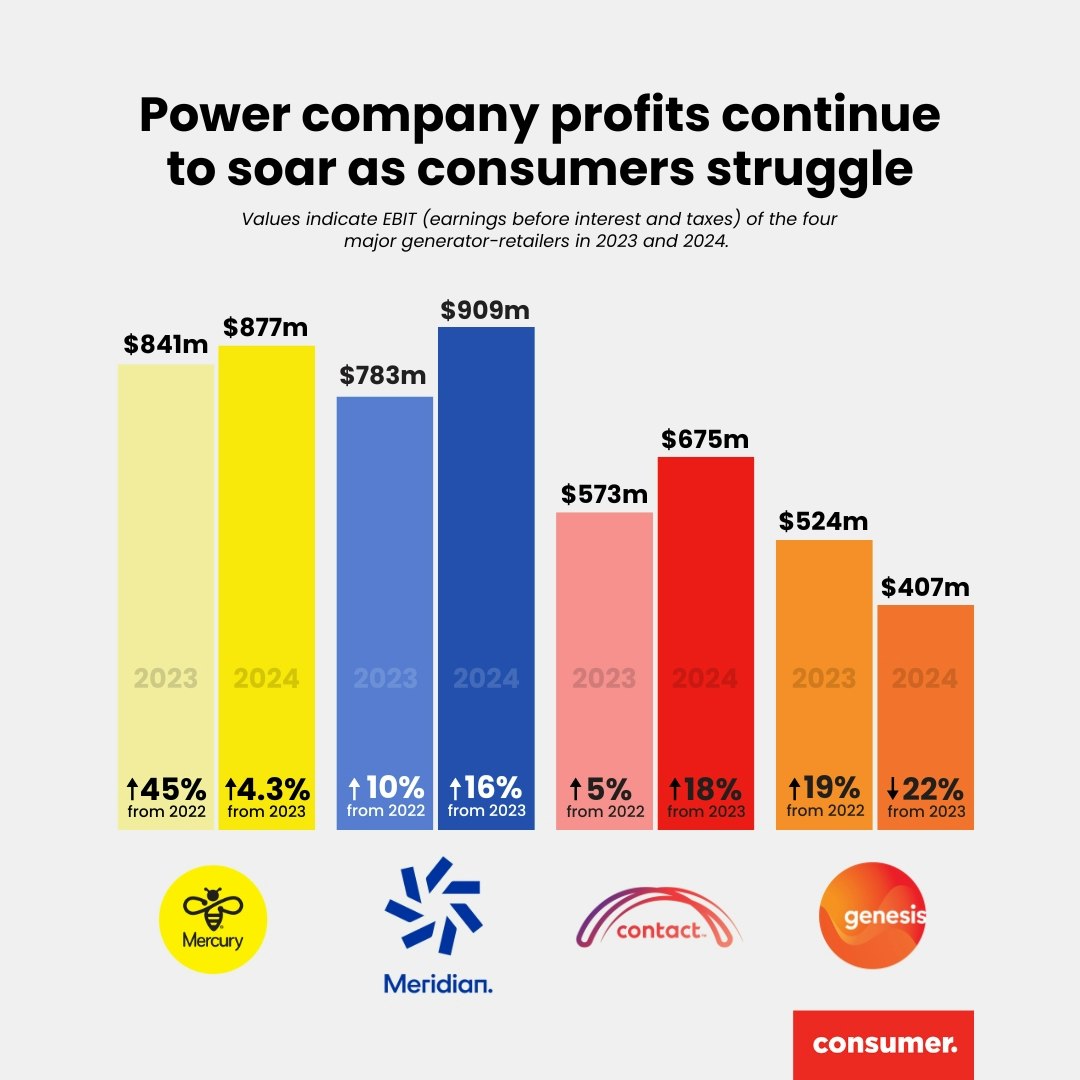

Those staggering statistics followed our previous announcement of the gentailers largest ever single-year rise in earnings – a whopping $2.7 billion in operating profits. That figure equated to profits of around $7.4 million a day over the previous 12 months. Where did all those profits go? It's fair to say that while profits were going up, prices were not coming down for most people. In fact, double-digit price hikes are hitting many customers this year. How did we get to this point, and what can be done about it?

Many in the industry claim these persistent high profits are needed to stimulate investment in new electricity generation. Gentailers say profit levels are aligned with a reasonable return on investment. However, the value of the assets is tied to returns – it’s a circular process: high returns justify increasing asset valuations, which justify higher returns, and on it goes.

For example, 25 years ago, the combined asset value of the four gentailers (mostly the value of their power stations) was around $7 billion. By 2022, that value had increased to $23.7 billion. While some new assets were created over that period, 46% of the increase ($11 billion) was through asset revaluations. Still, the anticipated investment in new generation has not materialised at the required levels. In fact, since the year 2000, New Zealand's total generation capacity has only increased by about 15%.

Ultimately consumers pay the price for the lack of investment in new generation, as we have lurched from energy crisis to energy crisis.

Key moments of crises

2001: A dry winter led to low hydro lake levels and concerns about energy security. A public campaign was launched to conserve power.

2003: Dry weather again affected hydro storage. The government initiated an electricity conservation programme. The crisis prompted discussions on the need for greater energy diversification.

2008: Drought-like conditions reduced hydro lake levels significantly, causing a spike in electricity prices and renewed efforts to manage consumption.

2021: August: A major system fault resulted in load shedding during a cold snap, affecting tens of thousands of homes. This highlighted issues in electricity infrastructure resilience.

2022: A dry winter led to low hydro storage.

2024: Another dry winter and low hydro storage.

Of course, power companies need to make a profit, but they should not be allowed to exploit their actual power to make excessive gains. A decent chunk of power companies' profits needs to be invested in new capacity so we can avoid future shortages. These huge profits should not just be distributed as dividends to shareholders.

We need an electricity market that puts people first.

We need to increase supply. While some investment is happening, it’s not enough.

We need to break up the gentailers’ market dominance. The fact that four companies control about 85% of the market is a massive problem. How can it be a competitive market when so few players hold so much power?

We need to empower people to find cheaper options. Simplifying and standardising power bills would be a quick way to help people understand their power use so they can easily compare options. The average annual household saving from switching to a cheaper power plan via Powerswitch is now around $500.

Large profits are necessary to satisfy shareholders, so there is a clear incentive for the gentailers to resist doing all the things needed to fix the unfairness in the electricity market. The biggest question of all must be, why are power providers able to put profits before people? That’s what really needs to change.

Which power company has the happiest customers?

See the full ratings of all power companies in our nationally representative survey.