Our guide to KiwiSaver

Compare KiwiSaver funds to find the best option for you.

What is KiwiSaver?

KiwiSaver is a voluntary, work-based savings scheme aimed at helping New Zealanders save for retirement.

How does KiwiSaver work?

If you join KiwiSaver, you will have to put a proportion of your pre-tax pay into a KiwiSaver scheme. As a rule, you can only access your KiwiSaver to purchase your first home, or when you turn 65.

There are some exceptions, such as if you are chronically ill, or if you are in significant financial hardship.

If you join KiwiSaver, you can choose which KiwiSaver provider to save with and what type of scheme to invest in. We've created a compare tool so you can find the right fund for you.

Is KiwiSaver compulsory?

No, joining KiwiSaver is not compulsory.

Is KiwiSaver worth it?

KiwiSaver is voluntary, so what are the benefits of joining the scheme?

The major benefit is the ‘free money’.

The government, and most employers, will contribute to your savings if you participate in the scheme.

How much does the government contribute to KiwiSaver?

The government will contribute 25 cents for every dollar you contribute to your KiwiSaver up to a maximum of $260.72 each year. To get the full amount, you need to contribute at least $1,042.86 of your own money every year.

If you earn a taxable income of over $180,000, you’ll no longer quality for a government contribution.

Does my employer have to match my KiwiSaver contributions?

At present, your employer must match your contribution dollar-for-dollar if you invest 3% of your pay cheque.

The default contribution is 3%, but you can choose to pay more. Some employers may decide to match higher contributions, but they aren’t obliged to pay more than the mandatory 3%.

How much do you have to contribute to KiwiSaver?

For employees, the minimum contribution you must make to KiwiSaver is 3% of your pre-tax pay. This will increase to 3.5% on 1 April 2026 and 4% on 1 April 2028 for both employers and employees.

However, you can choose to increase your contributions – to 6%, 8% or 10%.

If your employer matches your contributions beyond the default amount, you can get more free money by saving more of your pay. If you’re unsure what to contribute, consider speaking to a financial advisor.

What difference will my contribution make in the long-term?

We’ve looked at a couple of scenarios to show how a different rate of contribution could impact your nest egg.

Scenario 1: Just starting out

Our first scenario looks at a 25-year-old entering the workforce and starting up their KiwiSaver.

The 25-year-old earns $60,000, and their employer contribution is 4%. He chooses to invest his KiwiSaver in a balanced fund.

As his fund grows, and as that money is invested in the market, the difference between investing 4% and 10% diverges significantly.

By age 65, his nest egg (including interest) would be approximately:

$314,393 at 4%

$398,079 at 6%

$481,765 at 8%

$565,451 at 10%

Scenario 2: Starting again post-home purchase

Our second scenario looks at a 35-year-old who has used their KiwiSaver to purchase their first home.

Our 35-year-old earns $80,000, and their employer contribution is 4%. The house purchase has prompted them to think more about their money, and so they put their KiwiSaver in an aggressive fund.

Again, as the fund grows, because that money is invested aggressively in the market, the difference between investing 4% and 10% diverges.

By age 65, their nest egg (including interest) would be approximately:

$342,649 at 4%

$439,859 at 6%

$537,069 at 8%

$634,280 at 10%

Figures were calculated using sorted.org.nz calculators and tools, which account for taxation, interest and are inflation.

What is a KiwiSaver savings suspension?

If you can’t afford to contribute anything, you can take a savings suspension – what used to be known as a ‘contributions holiday’.

If you’ve been in KiwiSaver for a year or more, you can have a savings suspension of between 3 months and 1 year. You don’t have to give a reason, and you can have as many savings suspensions as you want, but you can’t take them back-to-back.

If you take a savings suspension, you will not get employer contributions unless your employer agrees otherwise. If you want to get the government contribution, you may need to make voluntary payments.

If you’ve been in KiwiSaver for less than a year, you can still have a savings suspension, but you will need to show evidence that you are experiencing, or are likely to experience, financial hardship for reasons outside your control.

The default period for a savings suspension is 3 months, but depending on your circumstances you may be given up to 1 year.

Be aware, though, that suspending your savings – particularly when you’re younger – may knock tens of thousands off your potential nest egg when you retire.

How much will a savings suspension cost me?

A savings suspension can have a major impact on your retirement savings. You’ll miss out on the savings themselves, investment returns, and years of accrued interest down the track.

We calculated the balances of two people joining KiwiSaver at age 25 who both contribute 4% of their $60,000 salary. One requires two year-long savings suspension between the ages of 25 and 30. The other does not require a savings suspension.

The loss of around $9,000 in savings between the ages of 25 and 30 leads to a $16,000 reduction in the first person’s KiwiSaver balance by the age of 65.

Figures were calculated using sorted.org.nz calculators and tools, which account for taxation, interest and are inflation.

How to choose a KiwiSaver provider

How often should I review my provider?

If you’re in a default scheme, or the one your employer chose, review your provider (and fund) immediately. Otherwise, re-evaluate your provider at least every 3 years. You can only belong to one scheme at a time.

How to change KiwiSaver provider

Start by looking at the fees charged by providers, which range from 0% to 3.55%.

Higher-fee funds don’t always outperform lower-fee ones. You can check out how funds have performed, and what fees they charge, at our comparison page.

Although a few percent might seem minimal, over the long term these fees eat away at your gains. Keep in mind some providers charge fees depending on the size of your balance.

Be careful comparing returns between different providers. This reflects the past, rather than giving a glimpse of the future

Some providers offer extra services, such as free ‘death by accident’ top-up cover. Others let you invest lump sums or split your investment between different types of funds (for example, between a balanced and a growth fund).

The impact of fees

A 25-year-old self-employed KiwiSaver member with a $10,000 KiwiSaver balance wants to put an average of $80 a week aside for her retirement. She could choose a fund with lower (0.25%), moderate (1%) or higher (1.62%) management fees.

Assuming a similar level of performance, we can see that fees can have a significant impact on her nest egg.

Lower-fee fund result: $275,327, with fees totalling $1,747 through to age 65.

Average-fee fund result: $269,737, with fees totalling $7,337 through age 65.

Higher-fee fund result: $265,683, with fees totalling $11,391 through to age 65.

Analysis courtesy of the Retirement Commission.

Is my money in the right fund?

Once you’re happy with your provider, your next decision is the appropriate fund type. Providers typically have several funds from which to choose.

Some funds play it safe to protect your capital. They’ll keep most of your money in bank deposits or other relatively secure cash assets, but won’t grow very quickly. Other funds take more risks with the aim of increasing long-term growth.

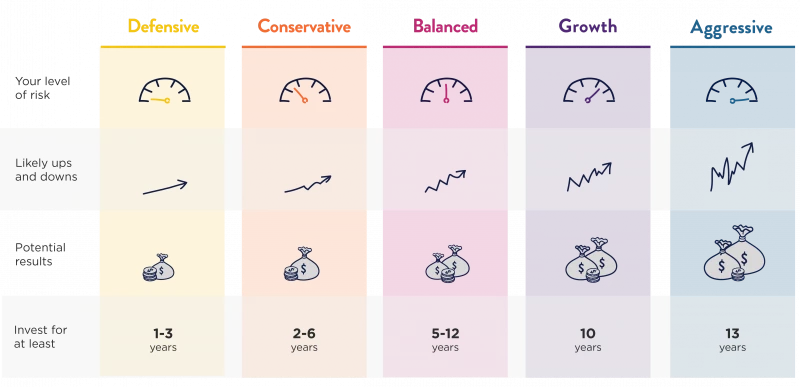

Here are the types of investment fund.

Defensive funds are the most cautious type and may be a wise option if you’re planning to retire or use the first home withdrawal in the next few years – but don’t expect high growth.

Conservative funds are another low-risk option. Usually about 10% to 35% of the fund is in higher-risk (growth) assets, such as shares and property. If you’re allocated to a default KiwiSaver provider, you’ll be enrolled in its conservative fund.

Balanced funds are split more evenly between growth assets (35% to 63%) and lower-risk investments, including bank deposits and fixed investments. This is a medium-risk option. You shouldn’t be intending to withdraw your investment within the next 5 to 10 years.

Growth funds are for longer-term investors intending to leave their money in KiwiSaver for at least 10 years. Growth assets will make up 63% to 90% of the investment. This is a medium- to high-risk option.

Aggressive funds are invested mainly in growth assets (more than 90%). They’re aiming for strong long-term growth, but there will be ups and downs along the way. This is the highest-risk option.

We’d recommend reviewing your fund type at least every 3 years. If you’re approaching retirement or planning to buy your first home, we’d recommend reviewing your fund annually. The arrival of your annual statement can be a useful prompt for any re-evaluation.

It’s important to invest your KiwiSaver strategically

The aim of the game is to benefit as much as possible from the potential growth of your investment, while minimising the risk that your fund will decline just before you want to use it.

As a rule, the more aggressive a fund is, the more it will grow over the long term.

The assumed long-term growth rates of funds differ significantly. The Financial Markets Authority assumes that a defensive fund will grow by 1.5% a year, while an aggressive one will grow by 5.5% a year.

For a 30-year-old with a balance of $30,000 contributing 4% of their $75,000 salary, leaving their money in each of the funds for the lifespan of their KiwiSaver could mean the difference between hundreds of thousands of dollars.

Defensive – $239,976.

Conservative – $286,811.

Balanced – $346,213.

Growth – $421,928.

Aggressive – $518,849.

More aggressive funds are likely to lead to more growth in the long-term, but in the short-term, they expose you to significant volatility. That’s why it’s important to make sure your KiwiSaver is in the right place at the right time.

Source: Sorted.org.nz

Source: Sorted.org.nz

If you’re just starting your career, and home ownership or retirement feel like a distant prospect, you might want to invest your KiwiSaver aggressively to benefit from growth. Similarly, if you’ve just used your KiwiSaver to purchase your first home, you might want to put it in a growth or aggressive fund to play catch-up.

If you’re just about to purchase a home, or you’re about to retire, you might want to lock in your gains, moving your savings to a more conservative fund until you’ve made your purchase or retired.

Can children join KiwiSaver?

Most KiwiSaver benefits aren’t available until children have turned 16. Under that age, a child won’t receive the $260.72 annual contribution from the government.

If they already have a job, they’ll have to wait until they’re 18 to receive the 3% contribution from their employer.

It’s likely the first chance they’ll have to access your cash is when they buy their first home.

Therefore, ask yourself if their money’s better off in a standard managed fund or savings account, where your child will be able to access it more easily, including when they’re studying.

How to withdraw KiwiSaver

How to withdraw KiwiSaver at 65

While there have been ‘lock-in’ periods in the past, anyone can now withdraw their KiwiSaver when they reach the age of eligibility – currently 65.

If you didn’t start paying into KiwiSaver until your 60s, there might be value in leaving your funds in KiwiSaver until they’ve been there for 5 years. If you withdraw your KiwiSaver after less than 5 years, you stop getting the government contribution and your employer stops contributing to your KiwiSaver.

You can choose to take out all your money in one go or in instalments (either regularly or as you need them).

Can I use KiwiSaver to buy a house?

If you’ve been paying into KiwiSaver for 3 years, you can use your savings to buy your first home.

The home (or land) must be in New Zealand, and you must intend to live in the property.

You are not eligible to access your KiwiSaver if you have made a first-home withdrawal before, or if you have owned land or a home before.

You must also leave $1,000 in your account.

Can I withdraw my KiwiSaver if I move overseas?

If you move overseas – with the exception of Australia – you can take most of the savings from your KiwiSaver account after one year.

You can withdraw:

your contributions

your employer's contributions

the $1,000 kickstart (if you got it)

fee subsidies (if you got these)

interest you have earned.

You cannot take out the government contributions.

Health reasons

You may be able to access your KiwiSaver early for health reasons if:

you have an illness, injury or disability that permanently affects your ability to work or poses a risk of death

you have a life-shortening congenital condition that lowers your life expectancy below the age of eligibility for New Zealand superannuation (currently 65).

If your application to withdraw is approved, you can withdraw some, or all, of your savings, including:

your contributions

your employer's contribution

the $1,000 kickstart (if you got it)

the government contributions

fee subsidies (if you got these)

interest you have earned.

If you applied because your condition was life-shortening and congenital:

you'll stop getting the government contribution

your employer will stop contributing to your KiwiSaver.

If you have a serious illness which prevents you from making contributions through your salary, you can apply for a savings suspension.

Can I withdraw my KiwiSaver for hardship?

You might be eligible to withdraw your KiwiSaver earnings before you turn 65 if you are experiencing financial hardship.

To withdraw savings, you will need to provide evidence that you are suffering significant financial hardship. This includes if you:

cannot meet minimum living expenses

cannot pay the mortgage on the home you live in, and your mortgage provider is seeking to enforce the mortgage

need to modify your home to meet your special needs or those of a dependent family member

need to pay for medical treatment for yourself or a dependent family member

have a serious illness

need to pay funeral costs of a dependent family member

need to pay for palliative care for yourself or your dependant.

Making a complaint

I have a complaint about my provider. What should I do?

Initially, you need to attempt to sort your problem out with your provider. You’ll find details on how to make a complaint in your provider’s product disclosure statement.

If that doesn’t resolve things, your next step is contacting your provider’s dispute resolution scheme. There are four schemes:

Banking Ombudsman (bankomb.org.nz)

Financial Dispute Resolution Service (fdrs.org.nz)

Financial Services Complaints Ltd (fscl.org.nz)

Insurance and Financial Services Ombudsman (ifso.nz).

These resolution services can ask your provider to compensate you if you’ve been left out of pocket. However, they can’t remove you from KiwiSaver.

Best and worst KiwiSaver providers

See what customers think of the 13 major providers in our survey.

Need our help?

The Consumer Advice Line is available to all our members for support on any consumer-related issue. Our expert advisers can explain your rights and help you resolve problems. Become a member now from just $12 and we'll help you get a resolution.